August 2025 Monthly Market Update

September 10, 2025

August 2025 Market Summary: Small Caps Lead Broad Rally, Labor Softens, Yields Decline

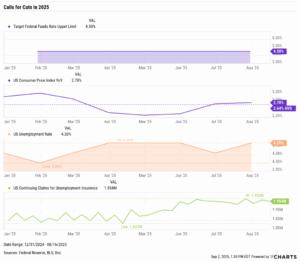

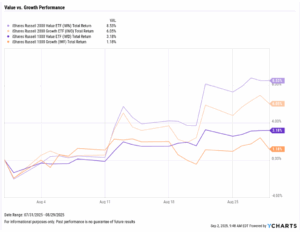

Markets moved higher across the board in August, with every major index posting gains. The Russell 2000 led with a 7.14% surge, while others had more modest advances. Despite macro uncertainty, August’s broad-based gains reflected improving investor confidence and participation, including a 4.27% rise in international developed equities.

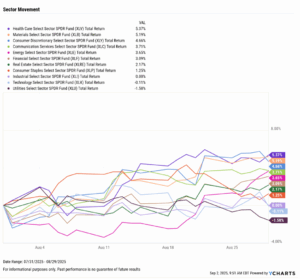

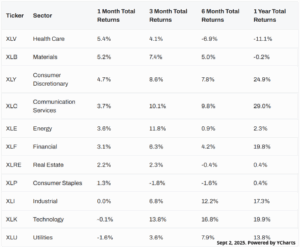

Sector performance showed a more balanced tone compared to July. Health Care rebounded strongly, gaining 5.4% to lead all sectors, followed by Materials at 5.2%. Technology and Utilities were the only declining sectors, as Industrials finished flat in August.

The U.S. labor market continued to weaken as the Unemployment Rate ticked up to 4.2% and Labor Force Participation declined for the fourth straight month. Just 73,000 jobs were added in July, missing expectations for the third month running. The Median Sales Price of Existing Homes fell 2.38%, marking the first monthly decline since January. The Fed Funds Rate remained unchanged, but a dovish tone from Fed Chair Powell at Jackson Hole increased speculation that rate cuts could arrive as soon as September.

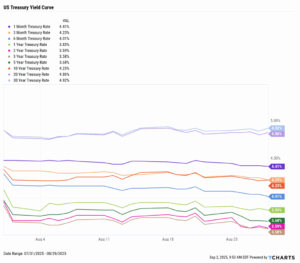

Treasury yields declined across the curve in August, apart from the 30-year, which finished three basis points above July’s level at 4.92%. The 2-year fell from 3.94% to 3.59%, the month’s most significant drop of 35 basis points, and the 3-year dropped to 3.58%, as markets increasingly priced in Fed rate cuts.

Chappell Wealth Watch! Expectations for Rate Cuts Accelerate

After months of mixed signals and market impatience, August marked a turning point in the case for rate cuts. At Jackson Hole, Fed Chair Jerome Powell acknowledged the shift, stating, “With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

With rates having held at 4.50% since the end of 2024, markets are now pricing in a 91% probability of a cut in September. This is a sharp reversal from the uncertain sentiment that clouded markets back in April. For advisors, this shift could be a signal to reexamine how portfolios are positioned for a changing rate environment.

Equity Performance: Small Caps Drive Market Higher, Health Care Leads Sector Comeback

Value vs. Growth Performance

US Sector Movement

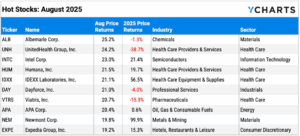

Top 10 S&P 500 Performers of August 2025

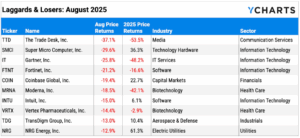

10 Worst S&P 500 Performers of August 2025

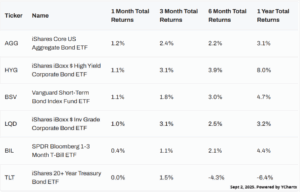

Economic Data Overview: Employment Softens Further as Inflation Holds, Markets Eye September Rate Cut

Employment

The unemployment rate rose slightly to 4.2%, while the labor force participation rate fell 0.1 percentage points for the fourth month in a row to 62.2%. According to the most recent nonfarm payrolls report, 73,000 jobs were added to the U.S. economy in July. This falls below the modest Dow Jones estimate of 100,000, marking the third consecutive month of payrolls missing expectations.

Consumers and Inflation

The US inflation rate rose to 2.70% in July, as did core inflation to 3.06%. The US Consumer Price Index rose 0.2% MoM, and US Personal Spending ticked up to 0.53%, falling right in line with its long-term average.

The Federal Reserve maintained its key Fed Funds Rate target range of 4.25%-4.50% at the July 30th meeting; however, Fed Chair Powell delivered a dovish address at Jackson Hole on August 22nd. The FedWatch tool is now assuming over a 91% chance of rate cuts when the FOMC next meets on September 17th.

Production and Sales

The US ISM Manufacturing PMI decreased 1.0 point in July to 48.0, following its only increase of 2025 in June. The Services PMI fell 0.7 points between June and July to 50.1, edging closer to contraction territory. The YoY US Producer Price Index increased sharply to 3.29% in July, following a decline in June. US Retail and Food Services Sales decreased slightly MoM, sitting at 0.51% growth for July.

Housing

While US New Single-Family Home Sales declined by 0.61% in July, Existing Home Sales grew by 2.04%. The Median Sales Price of Existing Homes fell by 2.38% in July, the first monthly decline since January of this year, with prices sitting at $422,400. Mortgage rates declined slightly throughout July; the 15-year Mortgage Rate was 5.69% as of August 28th, while the 30-year closed the month at 6.56%.

Commodities

The price of gold decreased by 0.41% in July. The SPDR Gold Shares ETF (GLD) increased by 4.99% in August to $318.07 per share. Oil prices fell in August, with Brent crude down 7.00% for the month to $68.29 per barrel. WTI dropped by 7.36% to $65.18.

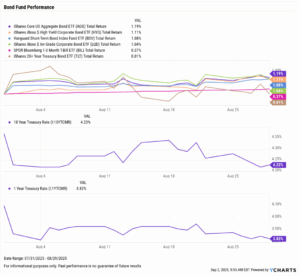

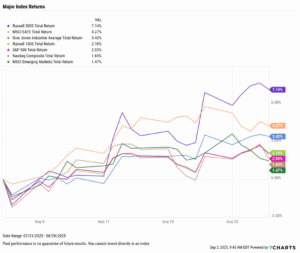

Fixed Income Performance: Insights into Bond ETFs & Treasury Yields

US Treasury Yield Curve

Bond Fund Performance