February 2024 Monthly Market Update

March 5, 2024

February 2024 Market Update

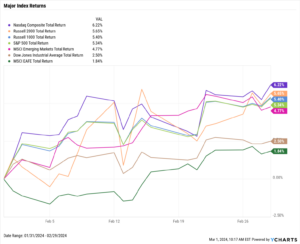

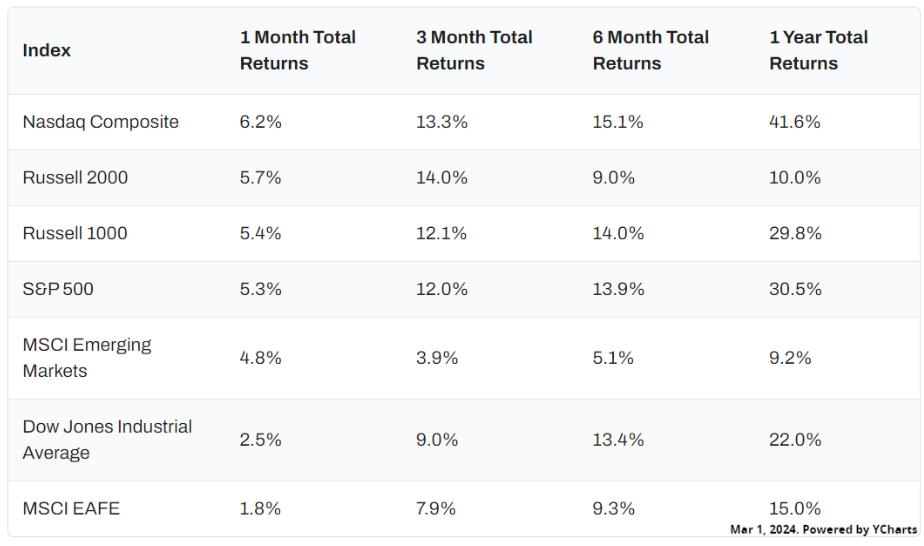

Equities rallied across the board as the NASDAQ led the way with a 6.2% gain. Both the Russell 2000 and Russell 1000 posted gains of around 5.5%, and the S&P 500 advanced 5.3%. The Dow Jones Industrial Average was the relative laggard but still rose 2.5%.

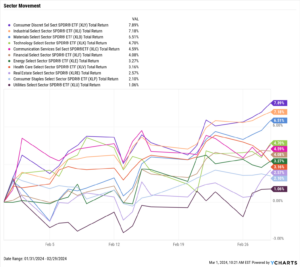

All eleven sectors advanced higher in February. Consumer Discretionary led the way with a 7.9% gain, followed by Industrials at 7.2% and Materials which charged 6.5% higher.

Core inflation has gradually decelerated over the last 10 months, down to 3.86% in January. Crude oil rose in February, causing the average price of gas to increase 13 cents to $3.37/g. After a flat January, Bitcoin and Ethereum logged respective gains of 45.9% and 44.2% in February, spurred by ETF inflows and ahead of March’s Bitcoin halving event.

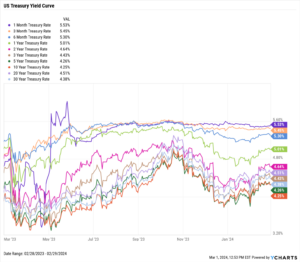

Treasury yields rose across the board even as equities rallied. Intermediate duration instruments posted the largest increases; the 2-year, 3-year, and 5-year all increased by 35 bps or more.

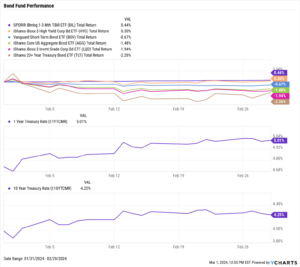

Bond ETFs largely mimicked their January performances in February. The short-term SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and iShares Boxx High Yield Corporate Bond (HYG) both inched higher. In long-term bonds, the iShares 20+ Year Treasury Bond ETF (TLT) fell 2.3% for the second straight month.

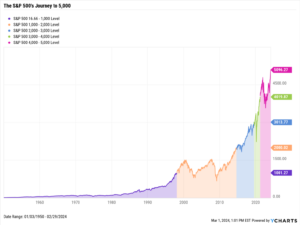

Chappell Wealth Watch! S&P Crosses Above 5,000

The S&P 500 reached a major milestone on February 9th when it closed above 5,000 for the first time.

It took the index 48 years to reach 1,000. The time it has taken for the S&P 500 to reach incremental 1,000-point levels has reduced dramatically in recent decades. The S&P 500 increased from 4,000 to 5,000 in just 2 years, 10 months, and 9 days.

Equity Performance

Major Indexes

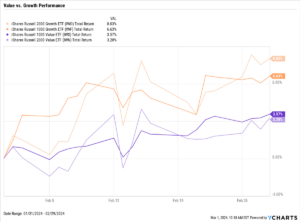

Value vs. Growth Performance

US Sector Movement

Top 10 S&P 500 Performers

10 Worst S&P 500 Performers

Economic Data

Employment

January’s unemployment rate stayed unchanged at 3.7%, as did the labor force participation rate at 62.5%. The US unemployment rate has now come in at 3.7% for three consecutive months. According to nonfarm payroll data, 353,000 new jobs were added in January, far surpassing the expected increase of 185,000.

Consumers and Inflation

The US inflation rate for January increased slightly to start the year, to 3.09%. Inflation has hovered in the 3 percent range since July, though it just logged its lowest YoY level since then. Core Inflation decreased slightly to 3.86% in January, nonetheless logging its 10th consecutive monthly decline. The monthly US Consumer Price Index rose 0.3% in January, and monthly US Personal Spending inched up 0.2%. The Federal Reserve held its key Fed Funds Rate at 5.50% at its January 31st, 2024 meeting, marking the Fed’s fourth consecutive meeting in which rates were left unchanged.

Production and Sales

The US ISM Manufacturing PMI failed to break into expansion territory, falling by 1.3 points in February to 47.8. December US Retail and Food Services Sales contracted by 0.8% MoM, while the YoY US Producer Price Index increased by 0.9%.

Housing

MoM US New Single-Family Home Sales increased 1.5% in January, and MoM US Existing Home Sales increased by 3.1% to 4.00M in January. The Median Sales Price of Existing Homes fell 0.6% to $379,100 in January, a seventh straight monthly decline putting it 7.6% below its all-time high set in June 2023. Mortgage rates increased slightly in February; the 15-year Mortgage Rate rose to 5.94% as of February 29th, and the 30-year ended the month at 6.94%.

Commodities

The price of Gold went largely unchanged in January to end the month at $2,048.10 per ounce. Crude oil prices continued higher in February; the price of WTI was 3% higher at $78.53 per barrel while Brent rose 1.2% to $84.01 both as of February 26th. Higher oil prices led the average price of gas to increase 13 cents per gallon in February, closing the month at $3.37 per gallon.

Fixed Income

US Treasury Yield Curve

Bond Fund Performance