January 2025 Monthly Market Update

February 5, 2025

January 2025 Market Summary: Stocks Drive Higher, Gold Soars to New All-Time High, Treasury Yields Largely Unchanged

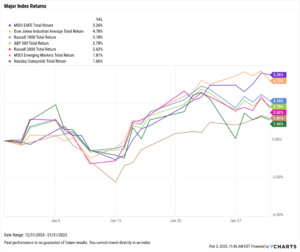

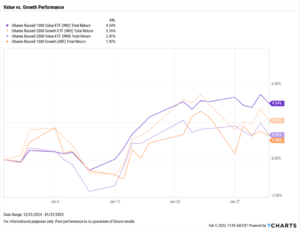

Equities got off to a strong start in 2025 with positive performances in January. The Dow Jones Industrial Average rose 4.8%, the S&P 500 advanced 2.8% and the Nasdaq Composite added 1.7%. Large-cap Value had the best month among Russell 1000 and Russell 2000 equity styles, increasing 4.5% in January.

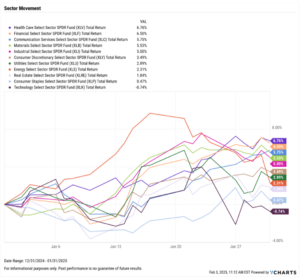

With the exception of Technology (-0.7%), all sectors rose in January. The best-performing sector in January was Health Care, which advanced 6.8%.

The US ISM Manufacturing PMI improved to 50.90, joining the Services PMI in expansion territory for the first time since March 2024. Gold jumped 7.8% in January to $2,812.10 USD per ounce and the price of Brent crude oil rose 3.6% amid looming threats of a possible trade war between the U.S. and various countries.

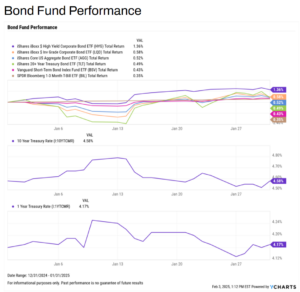

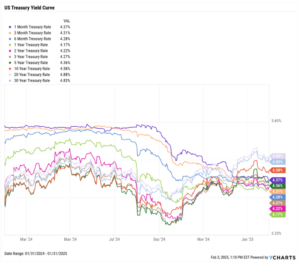

The yield curve remained largely flat month-over-month, with the largest move across the curve being the 3-month slipping 6 basis points. In bond funds, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) advanced 1.4%.

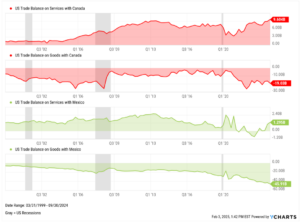

Chappell Wealth Watch! The State of a Potential Trade War

There are looming threats of U.S. imposed tariffs on certain countries, namely Canada and Mexico. What does the trade balance between each country look like?

Below are the U.S. trade balance figures between Canada and Mexico as of Q3 2024:

Trade balance on Services with Canada: $9.604 billion

Trade balance on Goods with Canada: -$19.03 billion

Trade balance on Services with Mexico: $1.295 billion

Trade balance on Goods with Mexico: -$45.91 billion

Equity Performance: Stocks Start Off Strong in 2025

Value vs. Growth Performance

US Sector Movement

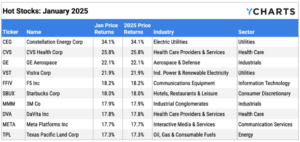

Top 10 S&P 500 Performers of January 2025

10 Worst S&P 500 Performers of January 2025

Economic Data Overview: Gold Surges Amid Looming Trade War, Manufacturing Sector Re-enters Expansion Terrirory by a Quarter Point, Inflation Remains Level

Employment

The unemployment rate slipped to 4.1% between November and December, and the labor force participation rate remained unchanged at 62.5%. November nonfarm payroll data showed that the U.S. economy added 256,000 jobs this month, the second straight monthly increase and surpassing the expected forecast of 155,000.

Consumers and Inflation

The US inflation rate inched higher for the third straight month to 2.89%, while core inflation decreased slightly to 3.24%. The US Consumer Price Index rose 0.39% month over month, and US Personal Spending increased by 0.66%.

The Federal Reserve maintained its key Fed Funds Rate target range of 4.25%-4.50% at the FOMC’s January 29th meeting.

Production and Sales

The US ISM Manufacturing PMI improved by another 1.7 points in January to 50.90, boosting the Manufacturing sector into expansion territory for the first time since March 2024. The Services PMI increased 2.0 points between November and December, bringing its latest reading up to 54.10. The YoY US Producer Price Index rose to 3.31% in December, while US Retail and Food Services Sales MoM 0.45% between November and December.

Housing

US New Single-Family Home Sales increased 3.6% MoM in December, while Existing Home Sales rose 2.2% MoM. The Median Sales Price of Existing Homes remained unchanged at $404,400 month over month, while mortgage rates rose slightly; the 15-year Mortgage Rate ended January at 6.12%, while the 30-year settled at 6.95%.

Commodities

The price of gold surged 7.8% in January to $2,812.10 per ounce in US Dollars amid intensification of a potential multinational trade war. Oil prices also shot higher; Brent crude oil rose 3.6% in January to $77.30 per barrel as of January 27th, while the price of WTI increased 1.5% to $73.51 per barrel as of January 27th. The average price of gas increased 9 cents MoM to $3.22 per gallon as a result.

Fixed Income Performance: Insights into Bond ETFs & Treasury Yields

US Treasury Yield Curve

Bond Fund Performance