January 2026 Monthly Market Update

February 5, 2026

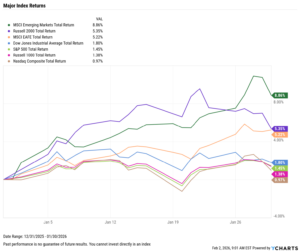

Market Summary: All Indices Advance, Technology Remains Flat as Rates Go Unchanged

Markets pushed higher in January as internationals finished in first once again. Emerging markets led the way, up nearly 9% for the month, as the S&P 500 advanced 1.5%. The Nasdaq posted the worst month of all indices, though still growing 1%.

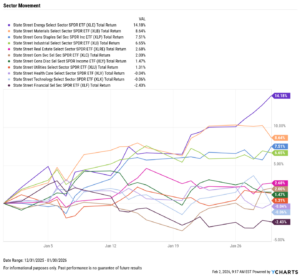

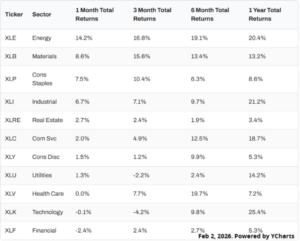

Sector performance was mostly positive, with Energy soaring 14.2%, almost twice as much as the next-best, Materials. Financials posted the worst month, down 2.4%, as Technology and Healthcare finished virtually flat.

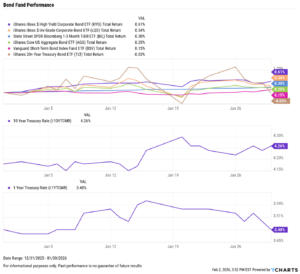

The Federal Reserve paused rate cuts after three consecutive 25-basis-point rate cuts to end 2025. Nonfarm payrolls missed expectations by 23,000 jobs in December, though the unemployment rate has continued to trend lower for the second month in a row. Housing prices continue to fall, and existing home sales activity spiked up 5.1% MoM. Looking ahead to the next FOMC meeting, markets expect just an 11% chance of resumed rate cuts as Chairman Jerome Powell closes out his term at the Fed.

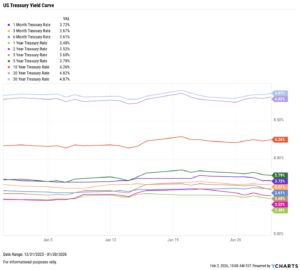

Treasury yield movements were small in January, though almost the entire curve ticked higher. The 1-month was the lone decliner, down just 2 basis points to 3.72%. The 3-month and 1-year rates went unchanged, while all others increased between 2 to 8 basis points.

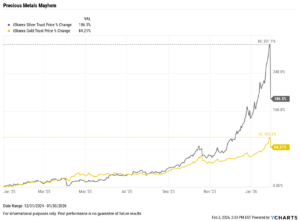

Chappell Wealth Watch! Standout Month for Precious Metals

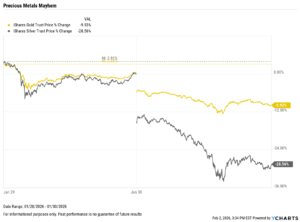

January 2026 will be remembered for extreme moves in assets that are typically far less volatile. In the lead-up to the final trading day of the month, precious metals had posted incredible gains and were still gaining momentum.

Silver had climbed as much as 301% since the start of 2025, while gold was up more than 105% over the same period. That momentum abruptly reversed on the final day of January, producing declines rarely seen for these otherwise defensive assets.

-

Gold fell nearly 10%, its worst one-day drop since 1983

-

Silver plunged more than 28%, marking its worst single-day loss since 1980

Despite this last-minute move in January, the US dollar has declined more than 10% since the beginning of last year, a key factor in this precious metal resurgence. Ongoing trade tensions and a rising national debt add another layer of uncertainty, which has benefited these assets.

This unique set of circumstances has led to more pronounced moves as seen in January, reinforcing that volatility is not limited to equities alone. YCharts helps advisors clearly explain these dynamics to clients, emphasizing the importance of diversification and the role each asset class plays in a well-constructed portfolio.

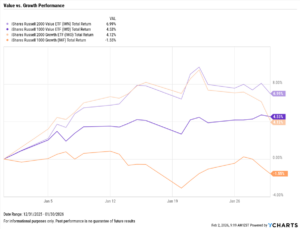

Equity Performance: International Markets and Value Continue to Lead, Energy Sector Soars

Value vs. Growth Performance

US Sector Movement

Top 10 S&P 500 Performers of January 2026

10 Worst S&P 500 Performers of January 2026

Economic Data Overview: Precious Metals Continue Surging, Fed Pauses Rate Cuts, and Housing Improves

Employment

The unemployment rate decreased by 0.1 percentage points to 4.4%, and 50,000 jobs were added to the U.S. economy, according to the most recent nonfarm payrolls report. This came in below the Dow Jones estimate of 73,000.

Over the whole year, total nonfarm payrolls increased by just 584,000 in 2025, the weakest annual job growth outside of a recession since 2003, when just 125,000 jobs were added.

Consumers and Inflation

The US inflation rate increased to 2.71% in December, as core inflation fell slightly to 2.66%. The CME FedWatch tool indicates just an 11% chance of the first rate cut in 2026 during the FOMC’s next meeting on March 18th. Rates were held steady at 3.50-3.75% in January, the first pause in cuts since September.

Production and Sales

The US ISM Manufacturing PMI decreased further to 47.9 in December, its third consecutive monthly decrease. The Services PMI increased 1.8 points to 54.4, further extending the divergence between the two. The YoY US Producer Price Index sits at 2.98% in December, while the US Retail and Food Services Sales increased by 0.61% on the month.

Housing

Existing Home Sales increased sharply by 5.07% MoM in December as the Median Sales Price of Existing Homes decreased to $405,400, its lowest since March of 2025. Mortgage rates were largely unchanged in January, ending the month at 5.49% for the 15-year and 6.10% for the 30-year.

While US New Single-Family Home Sales remain unreported, the NAHB Housing Market Index can be used to measure homebuilder confidence, providing an early indication of construction sentiment and future building activity.

Commodities

Gold posted another incredible month, increasing by 13.3%, leaving SPDR Gold Shares ETF (GLD) trading at $444.95 per share. Silver posted a fantastic December, ending 2025 up over 102% at $62.34 per ounce.

Oil prices increased as geopolitical tensions continued to raise concerns. Brent crude rose 10.4% for the month to $67.70 per barrel, as WTI increased by 5.59% to $60.46.

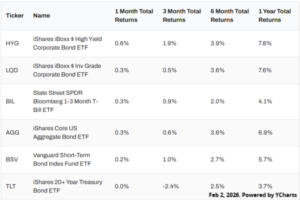

Fixed Income Performance: Insights into Bond ETFs & Treasury Yields

US Treasury Yield Curve

Bond Fund Performance