September 2023 Monthly Market Update

October 12, 2023

September 2023 Market Update

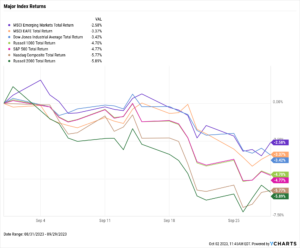

Stocks continued to decline in September as the Dow Jones Industrial Average fell 3.4%, the S&P 500 slipped 4.8%, and the NASDAQ ended 5.8% lower. Around the world, Emerging Markets were down 2.6%, and EAFE sank 3.4%. September’s declines dragged equities into the red for Q3. The Dow posted a 2.1% decline in Q3, the S&P 500 ended the quarter down 3.3%, and the NASDAQ 3.9% finished lower.

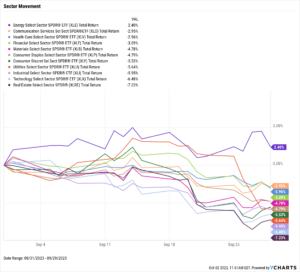

For the second straight month, Energy was the only US stock sector to post a positive return. Real Estate was the top laggard in September, tumbling 7.2%.

Regular gas prices topped $4 per gallon for the first time since October 2022. The higher gas prices resulted from a surge in crude oil prices. WTI crude oil briefly reached $90 per barrel in September–the first time since November 2022–while the price of Brent surged 7.7% to $94.01. Mortgage rates reached 20-year highs last month and pushed even higher in September. The 30-year mortgage rate surpassed 7% for the first time since April 2002.

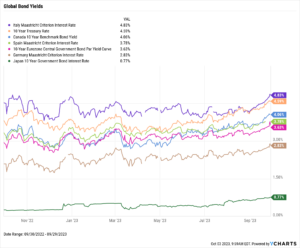

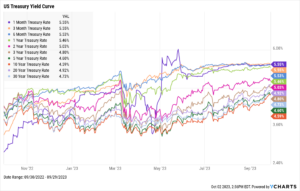

Yields on longer-term treasuries increased in September as T-Bills ended the month broadly unchanged. The 20-year and 30-year bonds each rose by 53 basis points. The 10-year’s 50 basis point increase helped reduce the inverted 10-2 treasury yield spread to -0.44%. Yields on global fixed-income instruments rose as well. Italy’s Long-Term Interest Rate surged 74 basis points, Canada’s 10-Year Benchmark Bond Yield jumped by 53 basis points, and Japan’s 10 Year Government Bond now yields 0.77%, an increase of 11 basis points.

Chappell Wealth Watch! Mortgage Rates and the Fed Funds Rate

The prevailing 30-Year Mortgage Rate, and its 15-Year counterpart, tend to follow the 10-Year Treasury Rate more so than the Fed Funds Rate. Mortgages are backed by bonds and securities, which align more with an instrument like the 10-year treasury. In the Fed’s fight with inflation, they don’t directly target long-term instruments, but since rates of most shapes and sizes experience a ripple effect from the Fed’s actions, mortgage rates tend to do the same.

Since February 2022, the 30-Year mortgage rate has climbed over 3 percentage points to 7.19%. If the current rate hike cycle ends, the 30-Year Mortgage Rate and its 15-Year counterpart might experience a period of stabilization or even a slight decrease, as the 10-Year Treasury Rate could also stabilize or decline. This could lead to more favorable mortgage conditions for homebuyers.

Equity Performance

Major Indexes

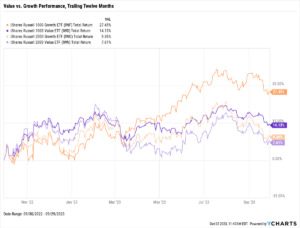

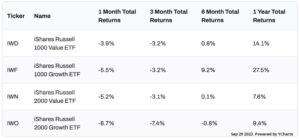

Value vs. Growth Performance

Trailing Twelve Months

US Sector Movement

Top 10 S&P 500 Performers

10 Worst S&P 500 Performers

Economic Data

Employment

August’s unemployment rate rose to 3.8%, three-tenths higher than July’s figure of 3.5%. However, the labor force participation rate grew by two-tenths to 62.8%. August nonfarm payroll data showed 187,000 jobs added, surpassing expectations of 170,000.

Consumers and Inflation

YoY inflation rose for a second straight month, from 3.18% in July to 3.67% in August. Conversely, Core Inflation fell to 4.35% in August, marking the fifth consecutive monthly decline. The US Consumer Price Index logged a monthly increase of 0.63% in August, its most prominent in the last 14 months. US Personal Spending was up 0.45% MoM. The Federal Reserve kept the benchmark Target Federal Funds Rate unchanged at 5.50% during its recent September 20th meeting.

Production and Sales

The US ISM Manufacturing PMI increased by 1.4 points in September to 49.0. This is the third consecutive monthly increase as the key manufacturing index approaches 50, the dividing line between expansion and contraction. US Retail and Food Services Sales grew by 0.56% MoM in August, and the YoY US Producer Price Index jumped to 1.6%.

Housing

US New Single-Family Home Sales contracted 8.7% in August, following a July in which new home sales grew by 8.0%. US Existing Home Sales sank for the third consecutive month, down 0.7%, and 17th out of the last 19. The Median Sales Price of Existing Homes inched 0.3% higher to $407,100, staying above $400,000 for the third straight month. Mortgage rates pushed higher in September; 15-year and 30-year Mortgage Rates ended the month at 6.72% and 7.31%, respectively.

Commodities

The price of Gold fell 3.7% in September, from $1,942.30 down to $1,870.50. WTI oil per barrel briefly reached $90 in September, ending the month at $89.68, an increase of 7.3%. Brent rose 7.7% in September to $94.01 per barrel. As a result, the average price of regular gas also eclipsed $4.00 per gallon in mid-September, settling at $3.96 as of September 25th.

Fixed Income

US Treasury Yield Curve

Global Bonds