November 2024 Monthly Market Update

December 5, 2024

November 2024 Market Summary: Stocks Rally, Home Sales Collapse, Bond Funds Appreciate

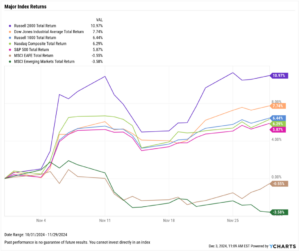

Equities rallied in November following the 2024 presidential election. The Dow Jones Industrial Average surged 7.7%, the Nasdaq Composite added 6.3%, and the S&P 500 advanced 5.9%. Certain ex-US markets weren’t as upbeat about the conclusion of the election, as Emerging Markets fell 3.6% and Developed Markets slipped 0.6%.

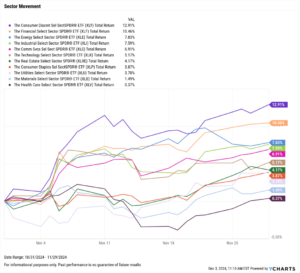

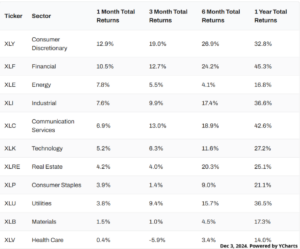

All eleven sectors finished November in the black. Consumer Discretionary and Financials were both up double digits, rising 12.9% and 10.5%, respectively.

Sales of new single-family homes logged its worst month-over-month change since July 2013, even as mortgage rates were largely unchanged. Both ISM sector PMIs advanced higher, and the Manufacturing sector got about within one point of expansion territory. The price of gold took a pause in its historic rally, but Bitcoin, sometimes referred to as “digital gold,” soared 34.7% in November and came within inches of $100,000.

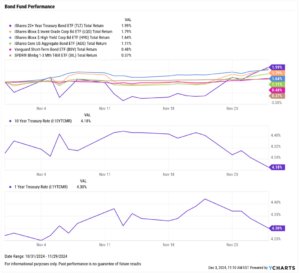

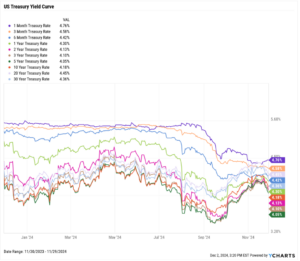

Treasury yield activity was rather muted in November. The 20-year experienced the largest move, falling 13 basis points.

Several bond funds managed price appreciation despite the relatively quiet activity in yield movement. The iShares 20+ Year Treasury Bond ETF (TLT) rose 2% in November, and the iShares iBoxx Investment Grade Corporate Bond ETF (LQD) advanced 1.8%.

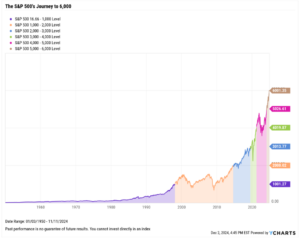

Chappell Wealth Watch! The S&P 500’s Journey to 6,000

The S&P 500 crossed 6,000 for the first time on November 11th, 2024. This is the second 1,000-point milestone to take place in the same year, as the index hit the 5,000-point mark back in February.

It took the S&P 500 just 9 months and 3 days to go from 5,000 to 6,000, which is the shortest amount of time ever to cross a 1,000 point threshold–and in stark contrast to the 48 years and 1 month that it took for the index to reach its first 1,000 point milestone.

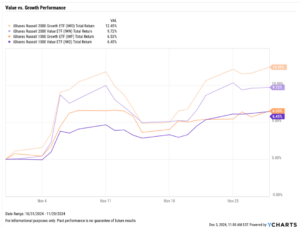

Equity Performance: U.S. Stocks Surge, Growth Sectors and Small Caps Lead Charge

Value vs. Growth Performance

US Sector Movement

Top 10 S&P 500 Performers of November 2024

10 Worst S&P 500 Performers of November 2024

Economic Data Overview: New Single-Family Home Sales Suffer Worse Month in Over 10 Years, Bitcoin Nears $100K

Employment

The unemployment rate remained unchanged at 4.1% between September and October, while the labor force participation rate fell 0.1 percentage points to 62.6%. October nonfarm payroll data showed that the U.S. economy added just 12,000 jobs this month, partially due to the recent hurricanes and dockworker strike. This was the lowest monthly jobs figure since December 2020 and well below the expected increase of 100,000.

Consumers and Inflation

The US inflation rate rose to 2.6%, ending a streak of sixth straight monthly declines. Core inflation came in at 3.33% for October. The US Consumer Price Index rose 0.24% month over month, and US Personal Spending increased by 0.36%.

The Federal Reserve cut its key Fed Funds Rate by 25 basis points at the FOMC’s November 7th meeting. This lowered the Fed Funds Rate down to 4.50%-4.75% from 4.75%-5.00%, and marks the second rate cut since March 2020.

Production and Sales

The US ISM Manufacturing PMI rebounded by 1.9 points in November to 48.40. The Services PMI added another 1.1 points between September and October, bringing its latest reading up to 56. The YoY US Producer Price Index bumped up to 2.4% in October, while US Retail and Food Services Sales increased 0.43% between September and October.

Housing

US New Single-Family Home Sales plummeted 17.3% MoM in October, the largest monthly decline since July 2013. On the other hand, Existing Home Sales increased 3.4% MoM. The Median Sales Price of Existing Homes remained relatively unchanged month over month, as did mortgage rates. The 15-year Mortgage Rate ended November at 6.10% while the 30-year settled at 6.81%.

Commodities

The price of gold took a breather from its historic run, shedding 3% in November and ending the month at a price of $2,651.10 per ounce in US Dollars. Brent crude oil rose 1.4% in November to $74.27 per barrel as of November 25th while the price of WTI was largely unchanged. The average price of gas fell 5 cents MoM to $3.17 per gallon.

Fixed Income Performance: Insights into Bond ETFs & Treasury Yields

US Treasury Yield Curve

Bond Fund Performance