Market Summary: Healthcare Surges, Key Economic Data Canceled as Rate Cuts Remain In Play

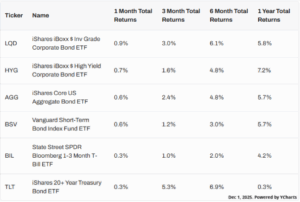

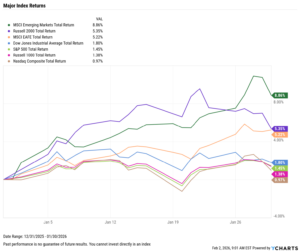

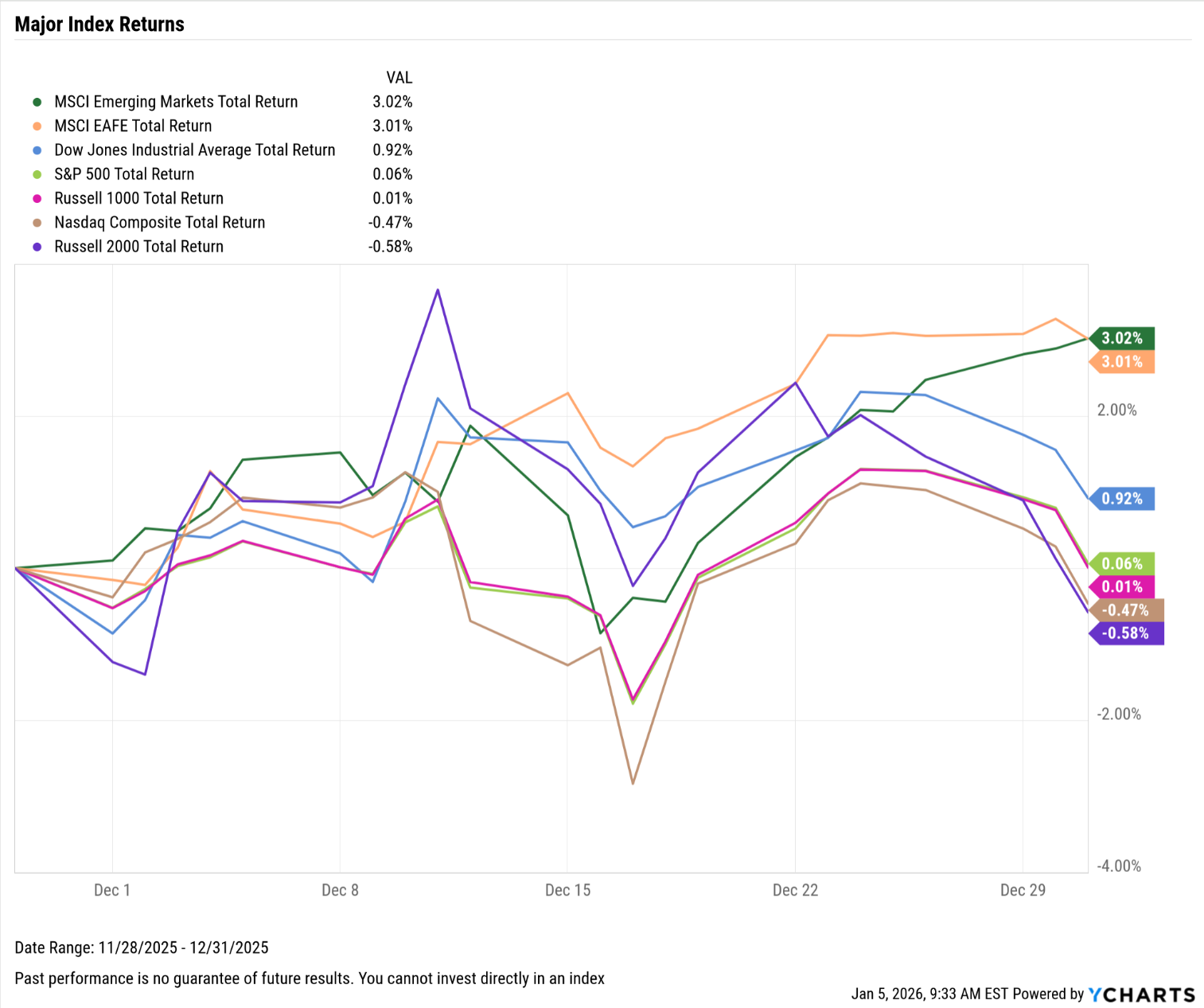

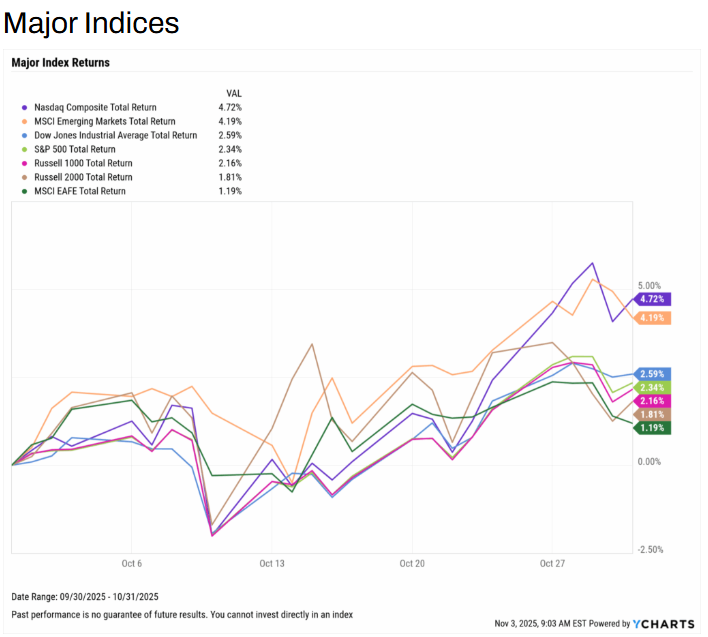

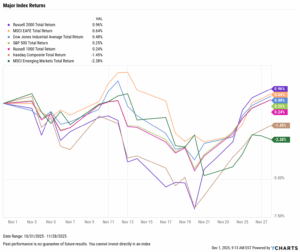

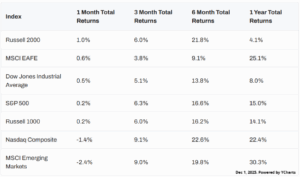

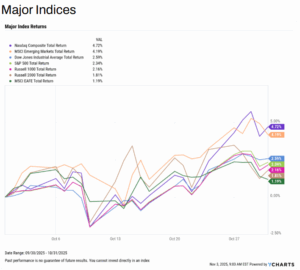

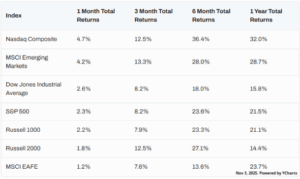

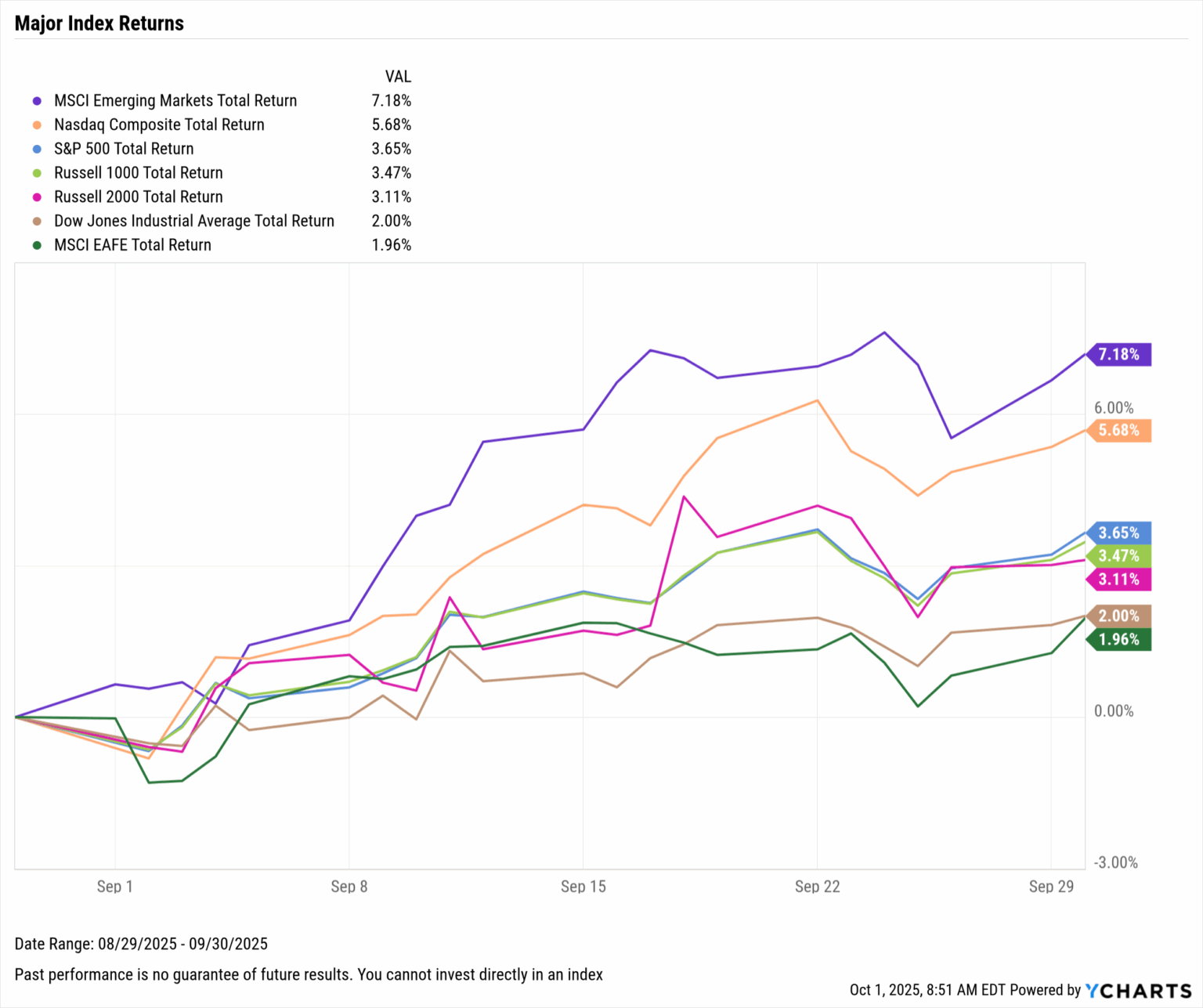

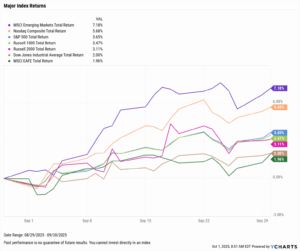

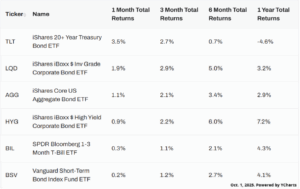

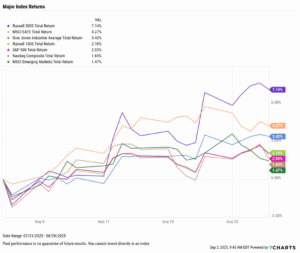

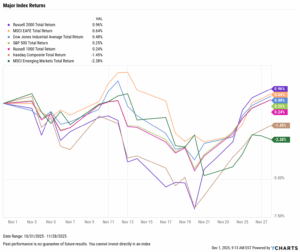

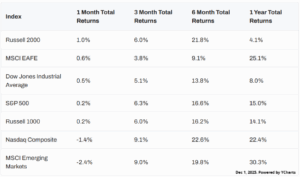

Markets were relatively flat in November despite heightened volatility as the S&P 500 posted a gain of 0.3%. Emerging markets took the biggest hit, ending the month down 2.4%, followed by the Nasdaq, which declined 1.5%.

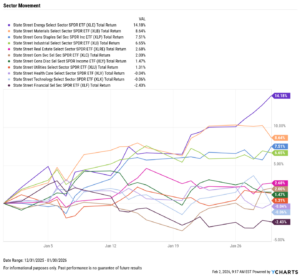

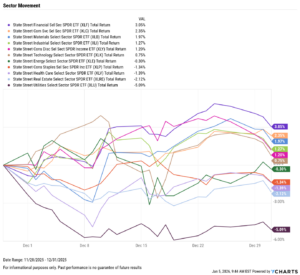

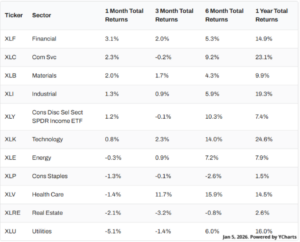

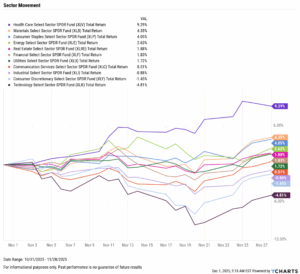

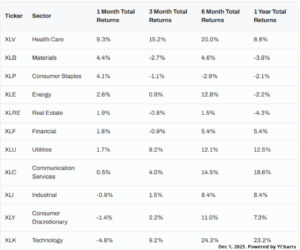

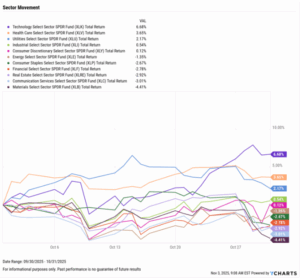

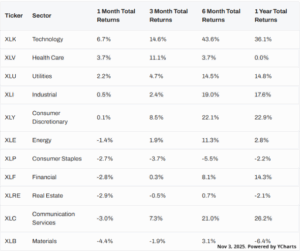

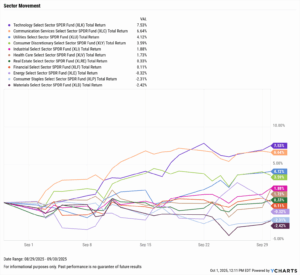

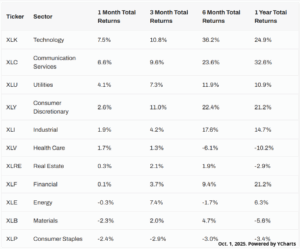

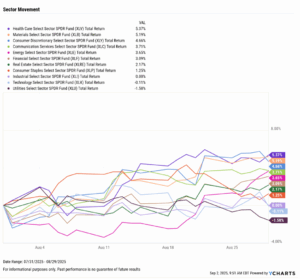

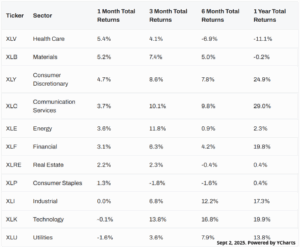

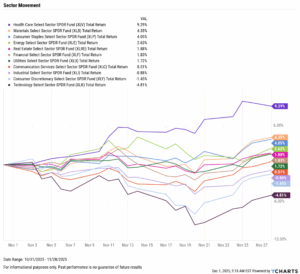

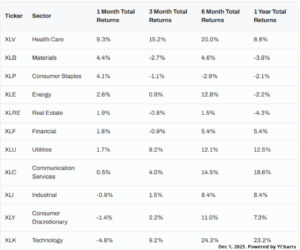

Sector performance was largely positive in November, led by the Healthcare sector, which advanced 9.3%. Technology lagged, down 4.8%, as Nvidia’s Q3 earnings dominated headlines. Despite a strong report, markets dropped off due to renewed concerns about an AI-driven market bubble. Communication, Real Estate, and Financials were all positive for the month.

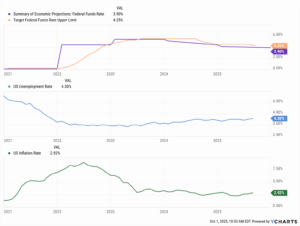

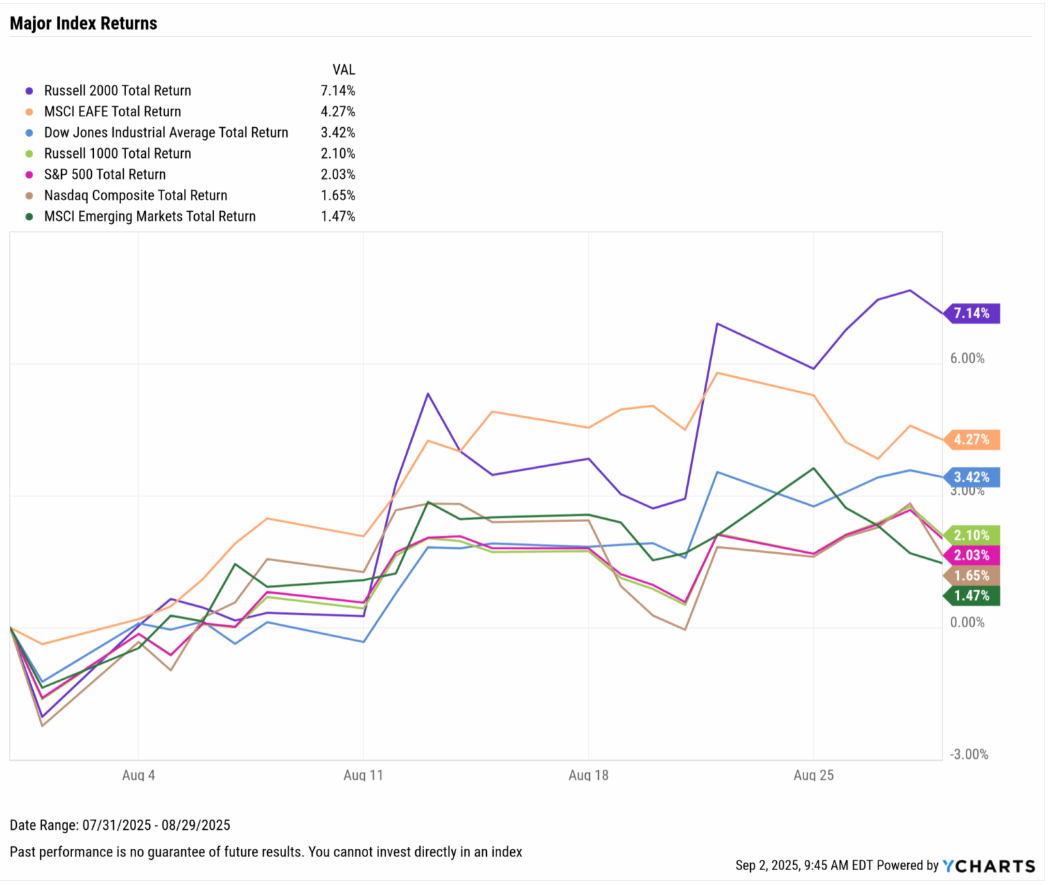

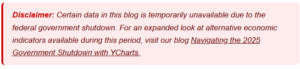

The government has canceled several key October economic releases, further limiting visibility into the broader economy. Nonfarm payrolls for September came in surprisingly positive, although unemployment ticked up slightly. The focus turns to the December 10th FOMC meeting, where markets are pricing in a third consecutive Fed Funds Rate cut of 25 basis points.

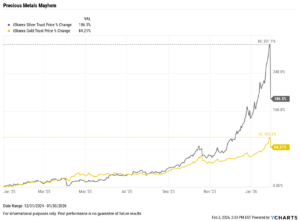

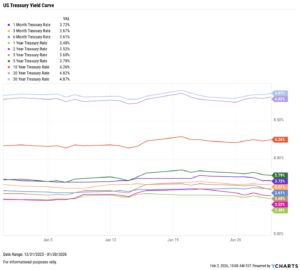

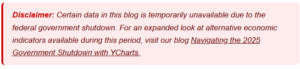

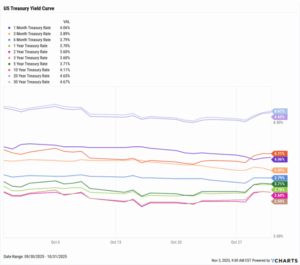

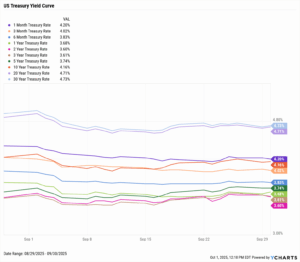

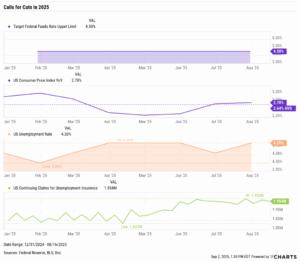

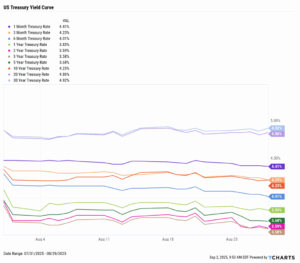

Treasury yields declined across the curve in November, with the 30-year yield serving as the lone outlier that remained unchanged. The largest decline occurred in the 2-year, which dropped 13 basis points to 3.47%, followed by the 5-year, which fell 12 basis points to 3.59%.

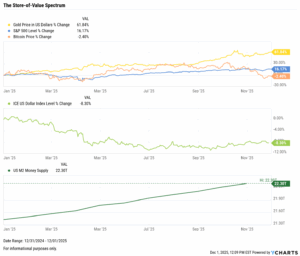

Chappell Wealth Watch! Diverging Value in the Same Environment

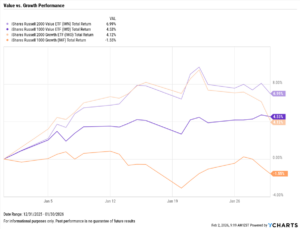

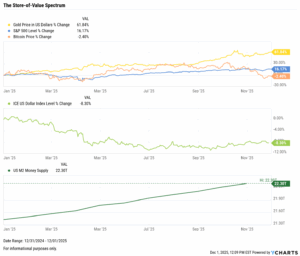

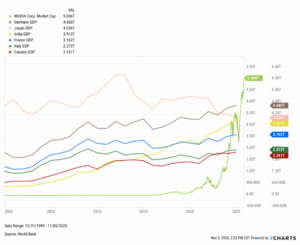

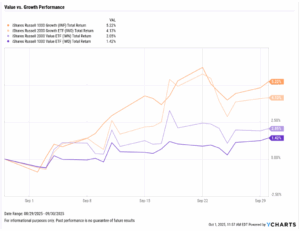

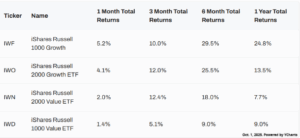

This year has been defined by significant market-moving headlines and economic conditions, which have tested the strength of investor sentiment. Tariffs, rate cuts, AI acceleration, and the longest government shutdown in history, to name a few, have left various asset styles sitting at surprising levels with one month remaining in the year.

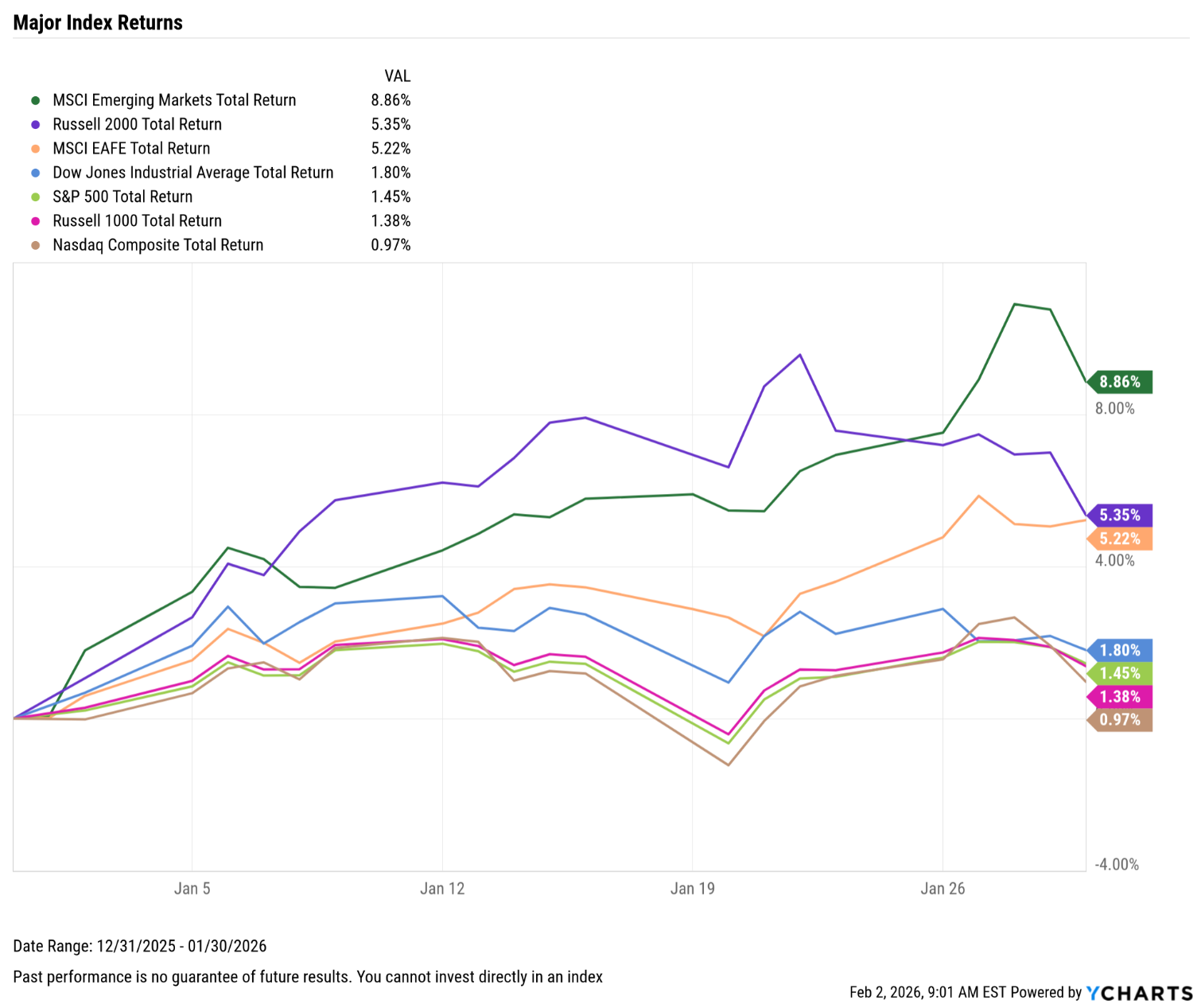

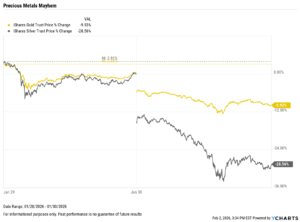

Gold has been the absolute standout. Up more than 60% year to date, it has responded consistently to rising money supply, persistent fiscal concerns, and a dollar that has fallen more than 8%. This combination has helped fuel steady demand for the most traditional form of value preservation, which gold has more than reflected throughout the year.

Bitcoin has moved in the opposite direction. Even amid expanding regulation and continued institutional attention, the cryptocurrency is down more than 2% in 2025, despite having been up 35% at one point.

The weaker dollar and rising liquidity that supported gold did not have the same effect on Bitcoin, creating a notable contrast for something often positioned as a modern-day store of value.

This split does not define their long-term roles, but it shows how differently assets can move under the same conditions. One traditional hedge surged while the proposed digital alternative gave back gains, offering advisors a reference point when discussing value preservation, risk tolerance, and how various asset styles may respond to shifting economic forces.

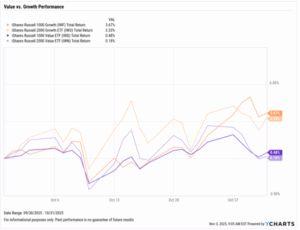

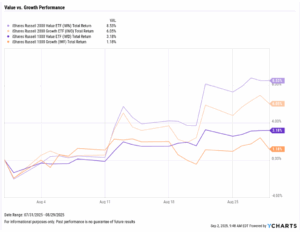

Value vs. Growth Performance

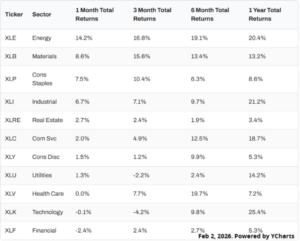

US Sector Movement

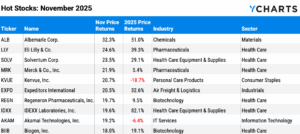

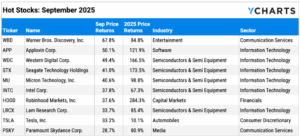

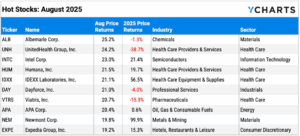

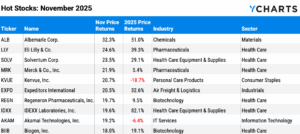

Top 10 S&P 500 of November 2025

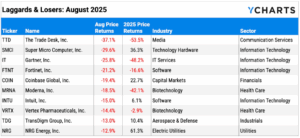

10 Worst S&P 500 Performers of November 2025

Economic Data Overview: Softening Labor Market Key to Fed Rate Cut, Housing Market Shows Signs of Recovery

Employment

September’s employment data has finally been released following the conclusion of the longest government shutdown in US history. The unemployment rate ticked up to 4.4%, and 119,000 jobs were added to the U.S. economy according to the nonfarm payrolls report. This came in well above the Dow Jones estimate of 50,000, a surprising beat for the first time in five months.

The Labor Department has confirmed the cancellation of October’s reports, although advisors can continue to track labor conditions in YCharts using alternative datasets. ADP Employment Change and ADP Private Employment provide monthly updates on private-sector payroll growth, while the Challenger Report highlights announced layoffs and sector-level shifts.

Consumers and Inflation

The Bureau of Labor Statistics has canceled the release of October’s inflation data, a big decision just before the Federal Reserve’s December rate meeting. In September, the US inflation rate rose to 3.01% and the US Consumer Price Index sits at 0.3% MoM.

The FedWatch tool now indicates an over 85% chance for a third consecutive cut when the FOMC meets next on December 10th. Despite lacking the full scope of key economic indicators, investors are increasingly pricing in another 25 basis point cut to close out 2025.

Production and Sales

The US ISM Manufacturing PMI decreased to 48.2 in November, its second consecutive monthly decrease. The Services PMI increased 2.4 points to 52.4 in October. The YoY US Producer Price Index and US Retail and Food Services Sales have both remained unreleased since September due to the federal shutdown.

Housing

Existing Home Sales increased by 1.2% MoM in October, and the Median Sales Price of Existing Homes remains at $415,200. Mortgage rates increased slightly throughout November, with the 15-year Mortgage Rate at 5.51% and the 30-year at 6.23% to end the month.

While US New Single-Family Home Sales remain unreported, the NAHB Housing Market Index can be used to measure homebuilder confidence, providing an early indication of construction sentiment and future building activity.

Commodities

The price of gold increased this month by 6.2% following what was a volatile October. SPDR Gold Shares ETF (GLD) sits at $387.88 per share. Oil prices decreased, with Brent crude down 0.9% for the month to $64.83 per barrel. WTI was hit a bit harder, down by 4.3% to $59.11.

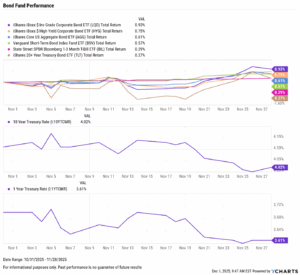

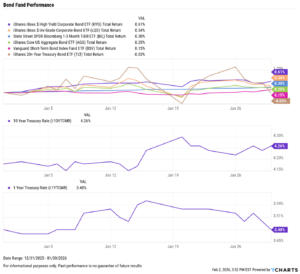

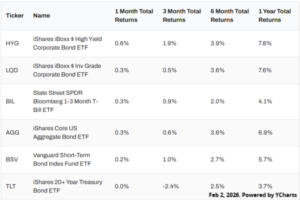

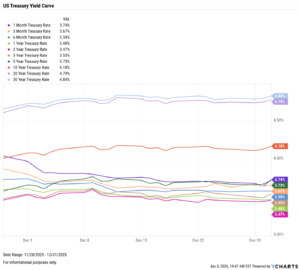

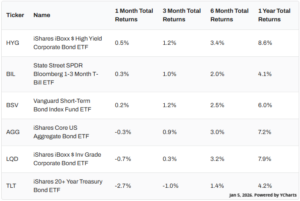

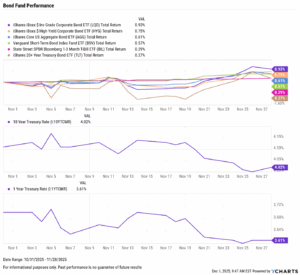

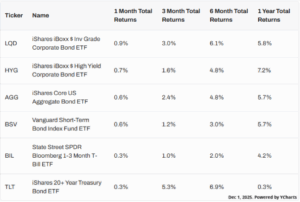

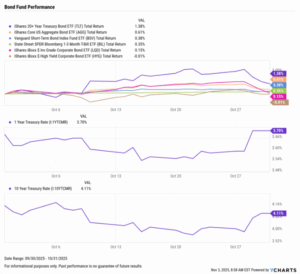

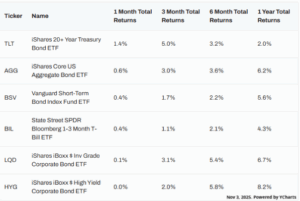

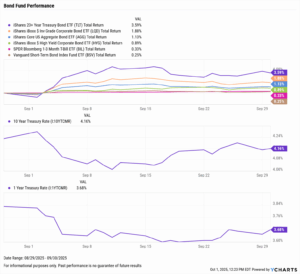

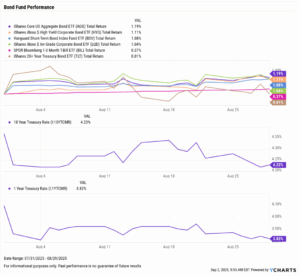

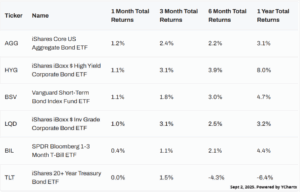

Fixed Income Performance: Insights into Bond ETFs & Treasury Yields

US Treasury Yield Curve

Bond Fund Performance