July 2025 Market Summary: Stocks Rise to Start 2H 2025, Median Sale Price of Existing Homes Hits New High, Treasury Yields Rise

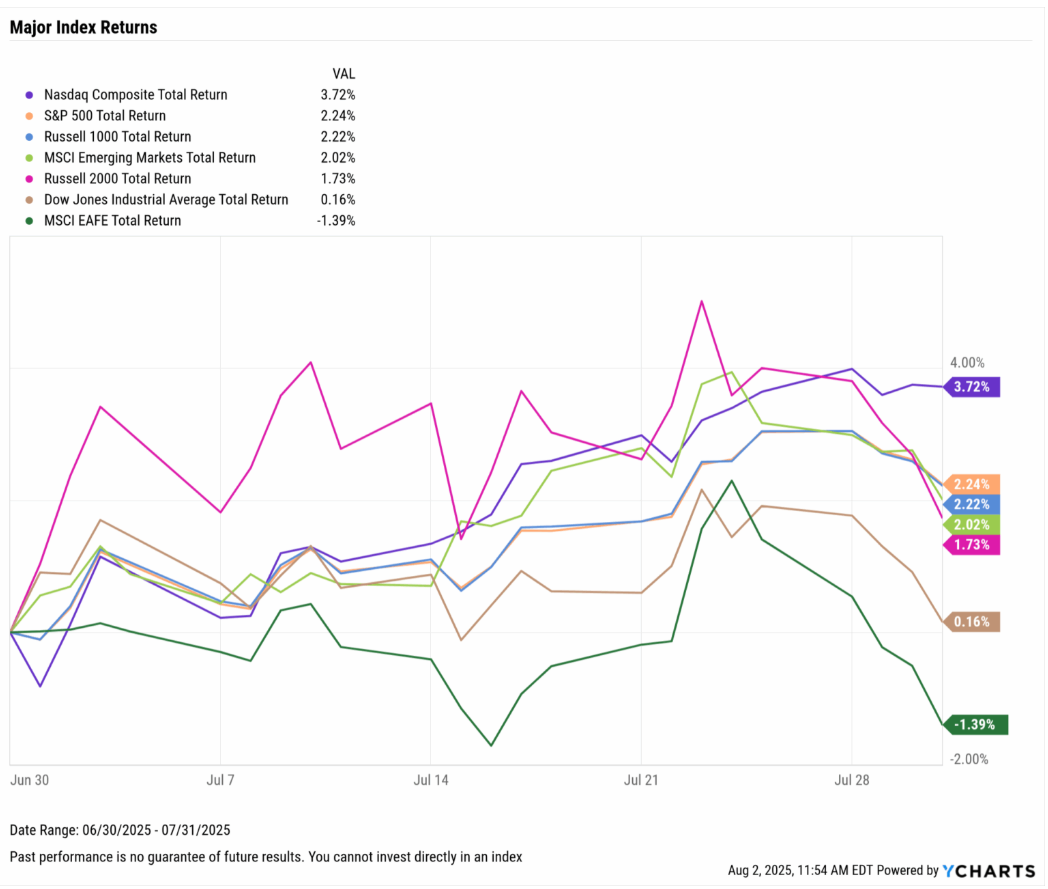

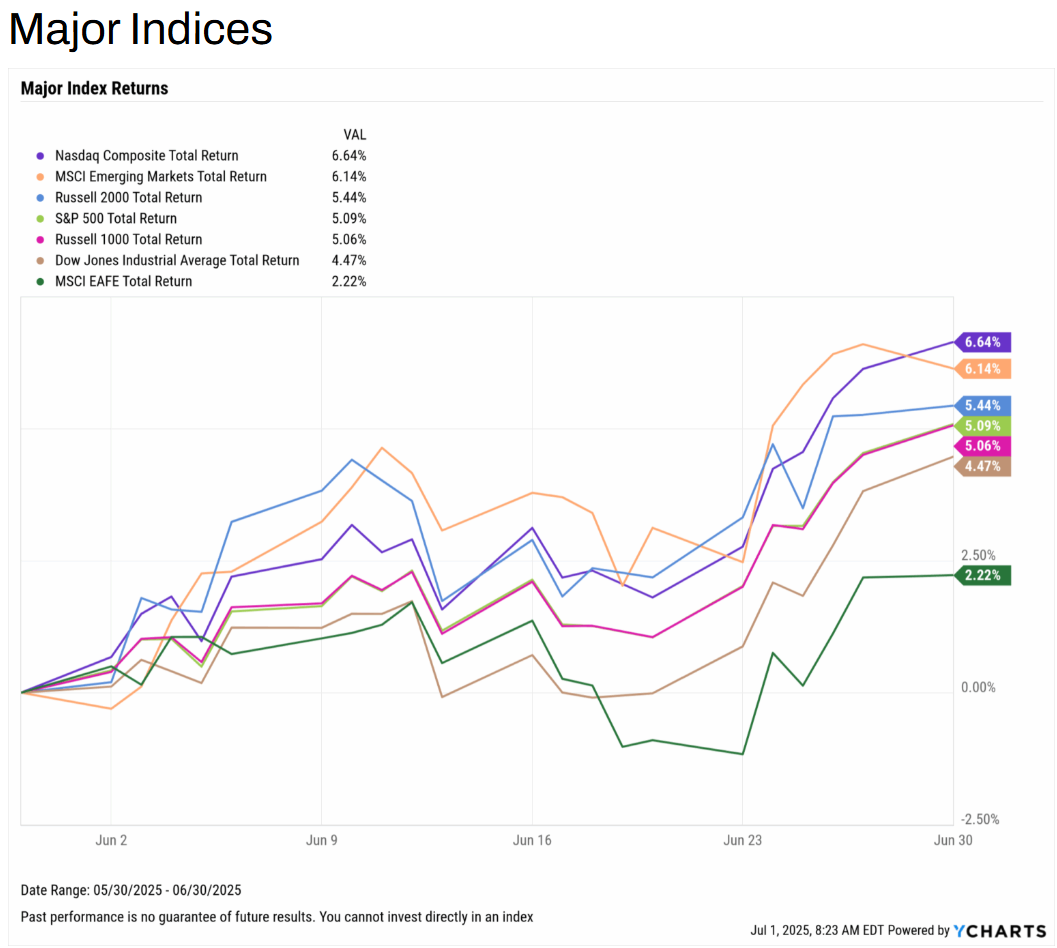

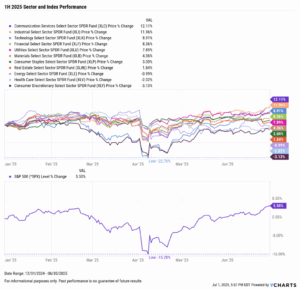

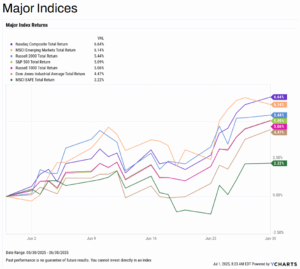

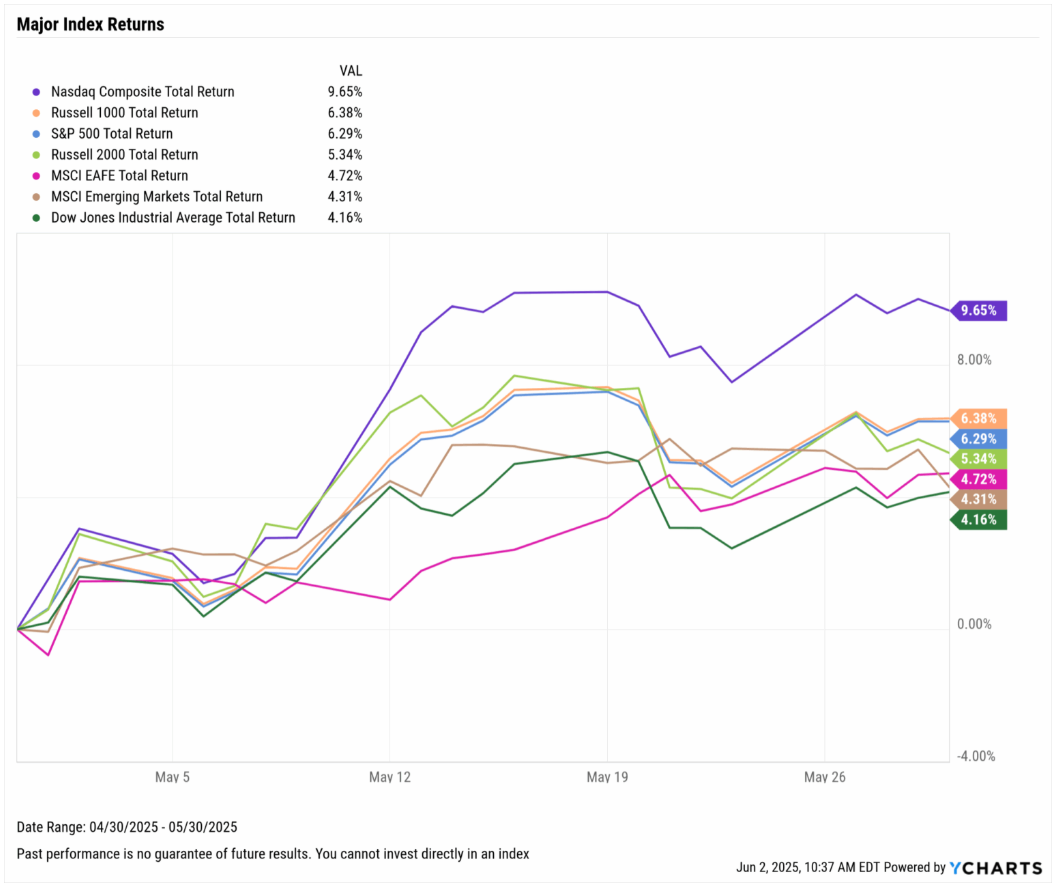

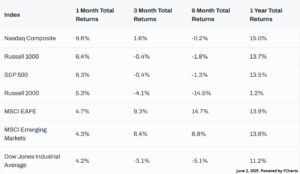

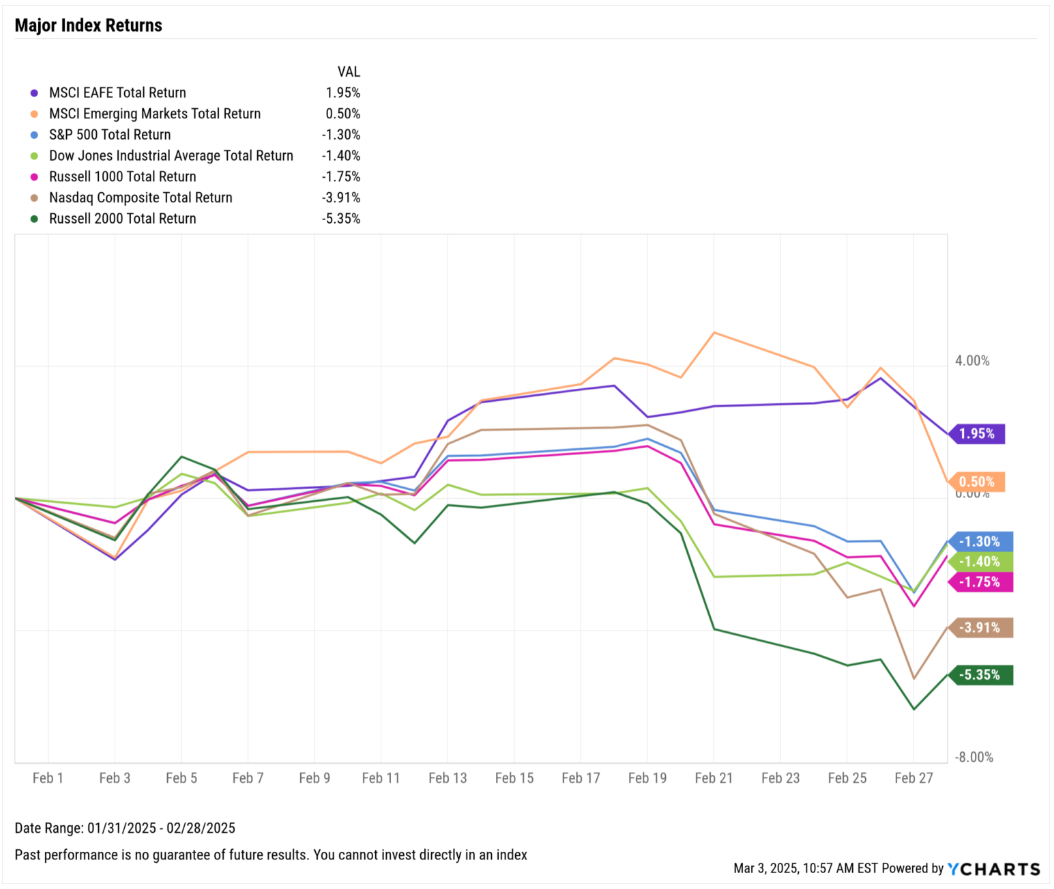

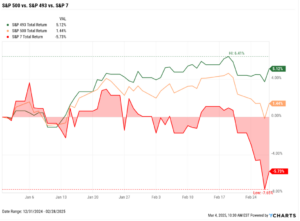

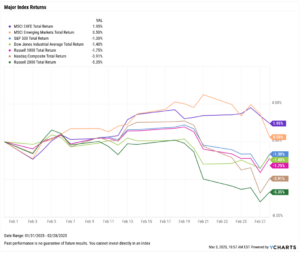

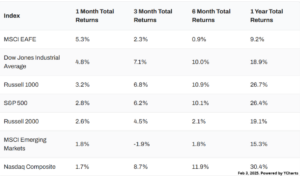

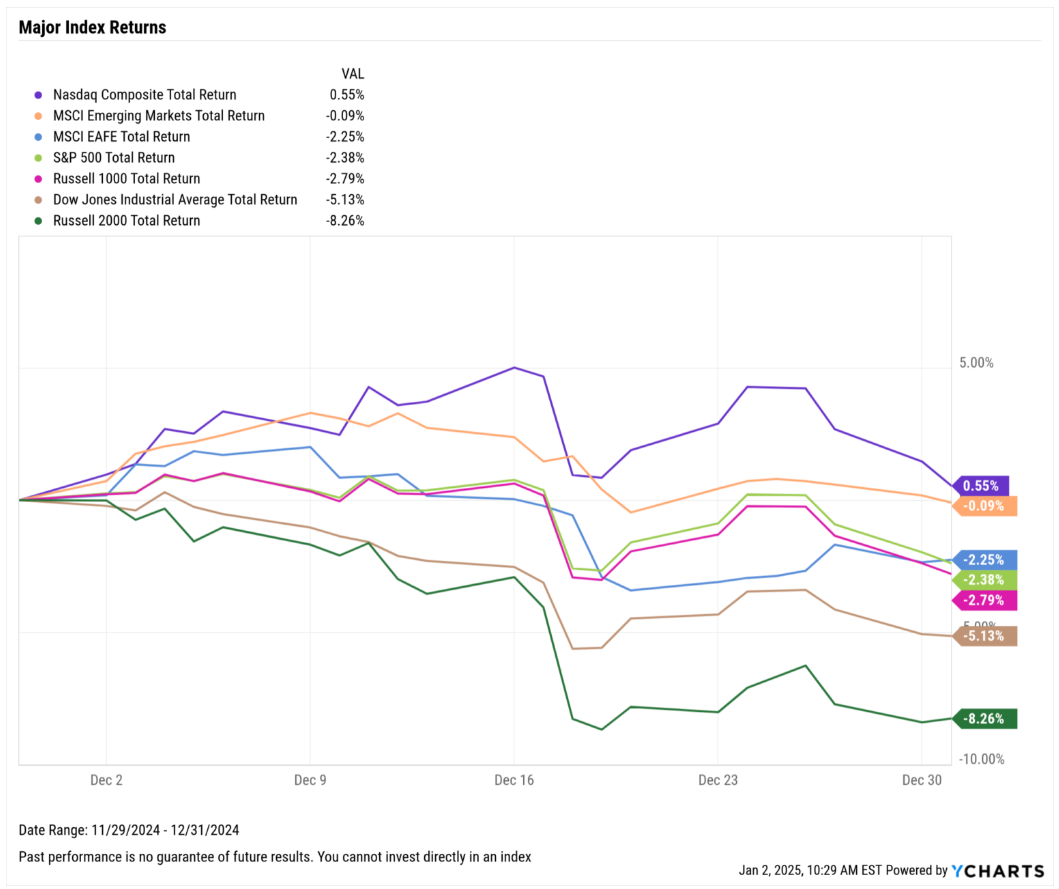

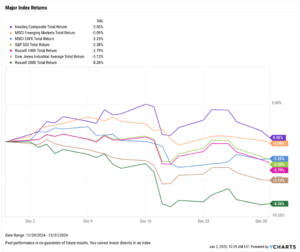

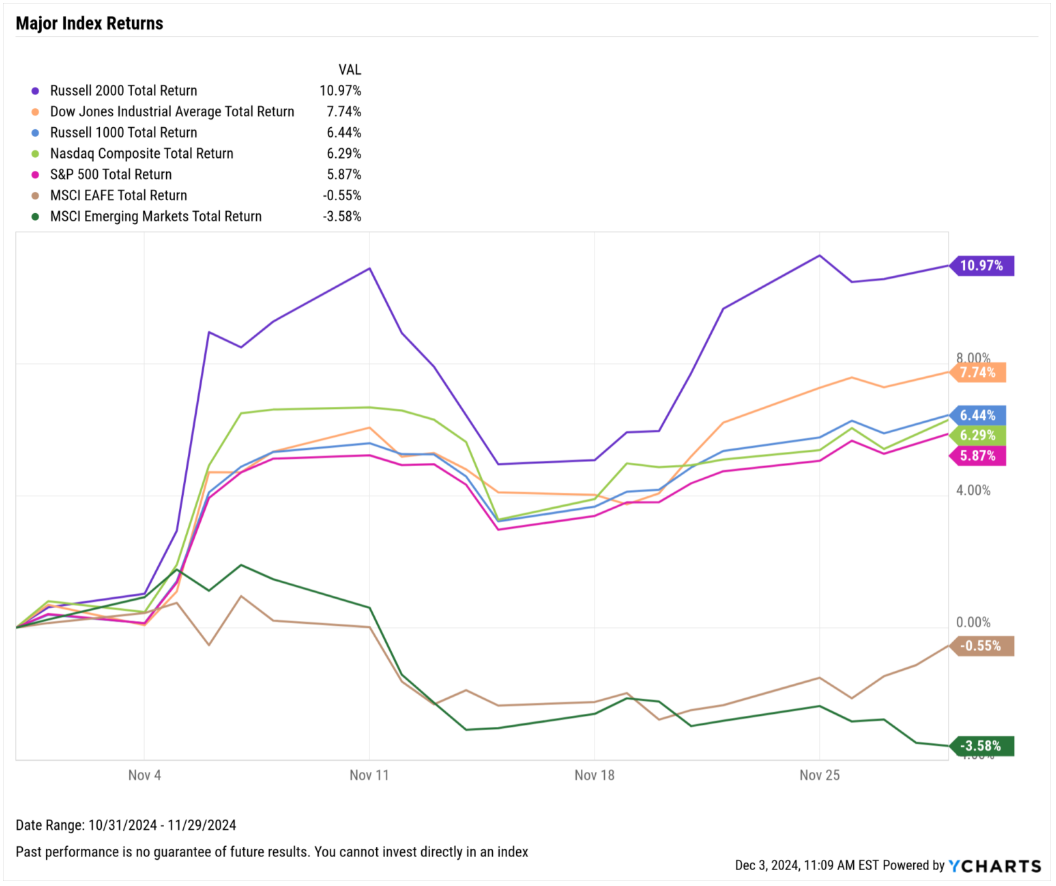

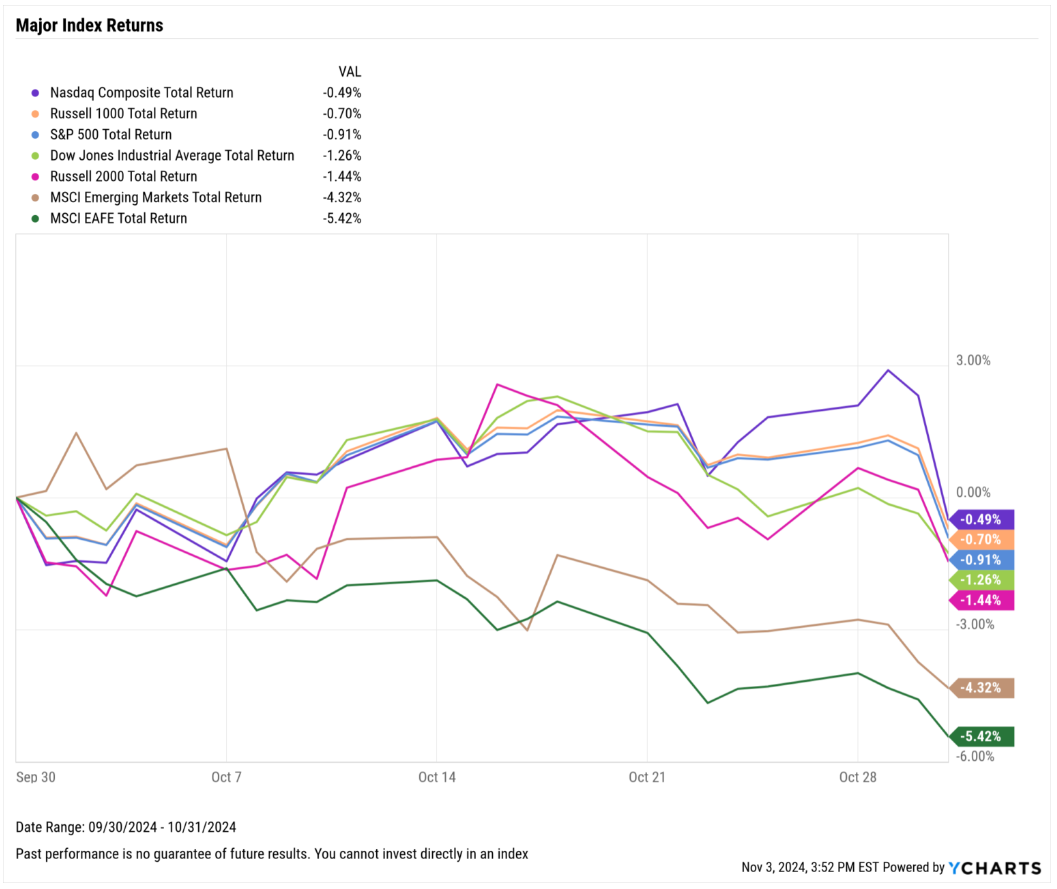

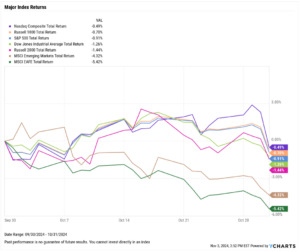

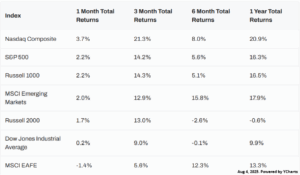

Equities kicked off the second half of 2025 on a mostly positive note with most indices posting gains in July. The Dow Jones Industrial Average rose 0.2%, the S&P 500 added 2.2%, and the Nasdaq Composite advanced 3.7%. Only Developed EAFE Markets had a negative July, shedding 1.4% in the month.

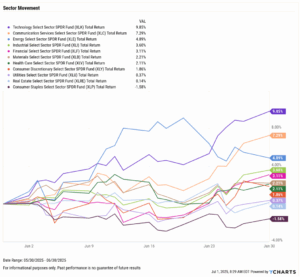

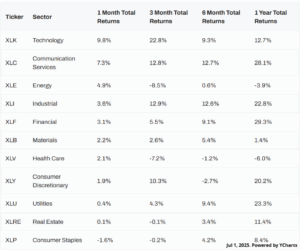

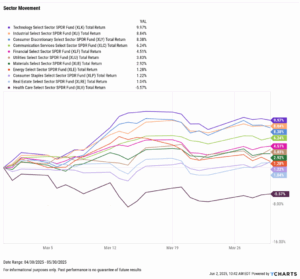

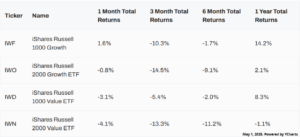

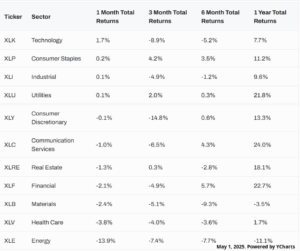

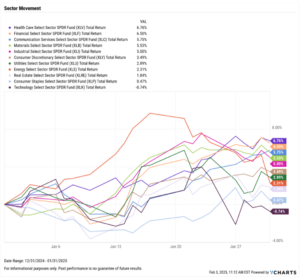

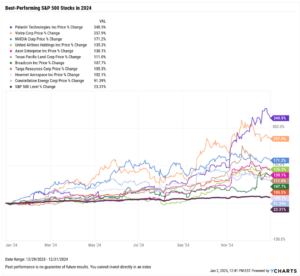

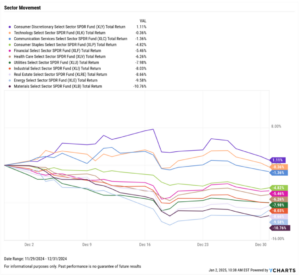

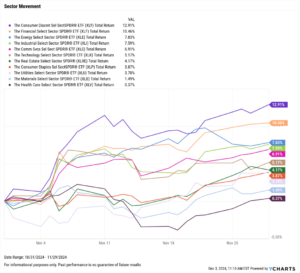

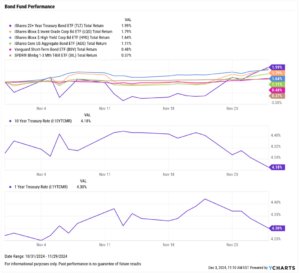

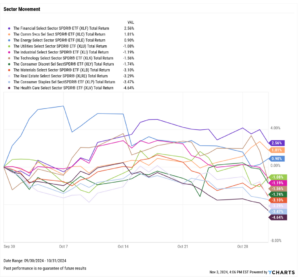

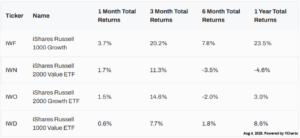

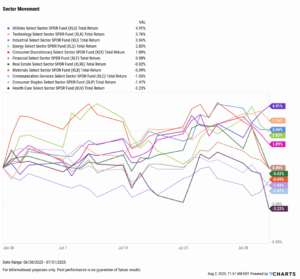

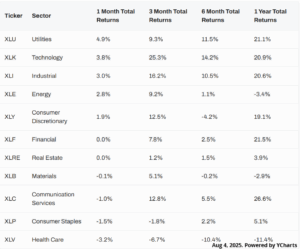

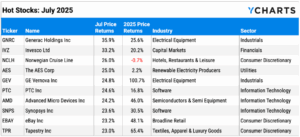

The most defensive and most cyclically-sensitive sectors topped the list for July: Utilities and Technology, which rose 4.9% and 3.8%, respectively. Industrials came in third place with a 3% gain. Six of the ten worst-performing S&P 500 stocks in July were Health Care names, dragging the sector down by 3.2%, making it the worst performer in July.

The Median Sales Price of Existing Homes rose to $435,500 in June, setting a new all-time high for the first time in twelve months. Oil prices spiked further in July following a volatile June; the price of Brent crude spiked 4% in July, while WTI rose 2.3%. The Federal Reserve maintained its key Fed Funds Rate target range of 4.25%-4.50% at the FOMC’s July 30th meeting, but the majority of investors currently anticipate the Fed will cut the target rate by 25 basis points at its next meeting on September 17th.

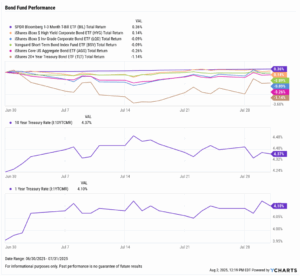

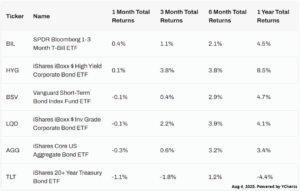

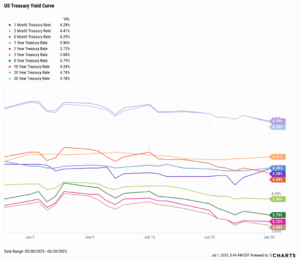

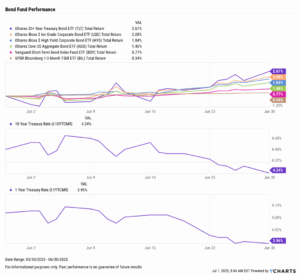

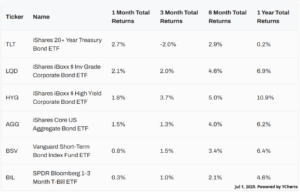

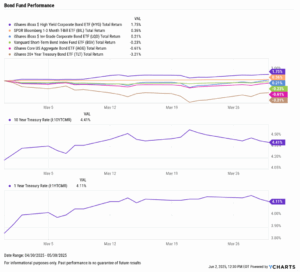

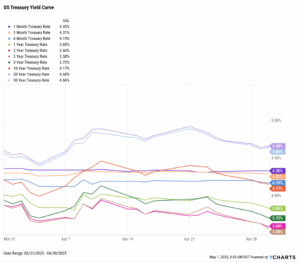

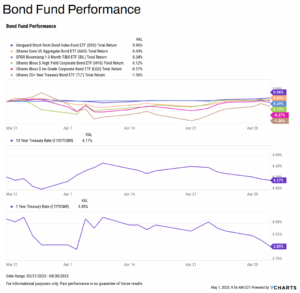

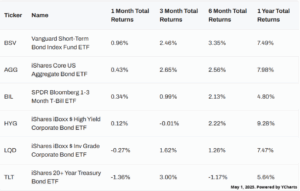

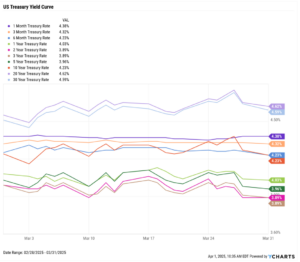

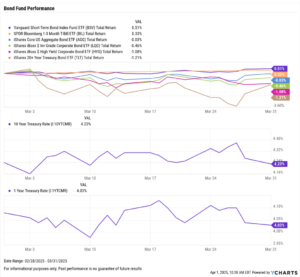

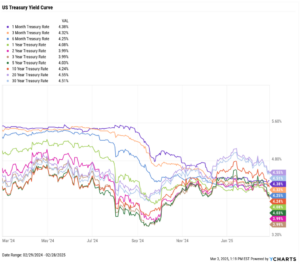

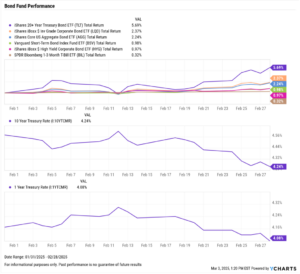

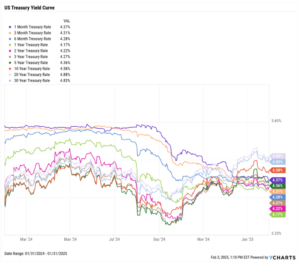

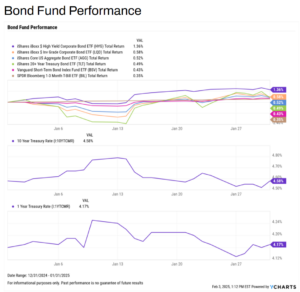

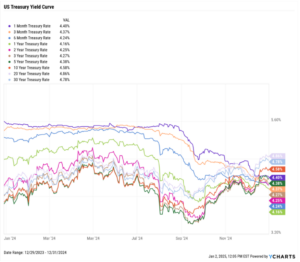

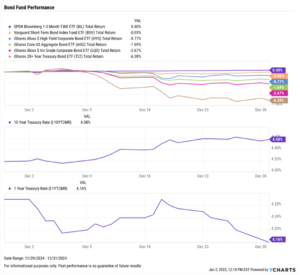

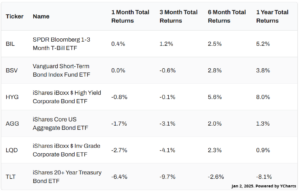

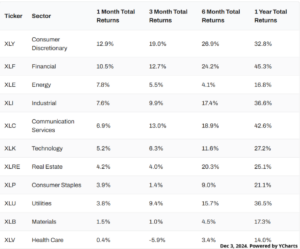

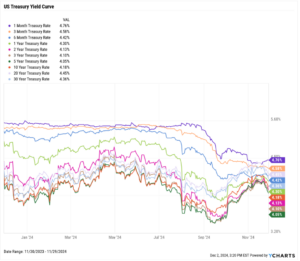

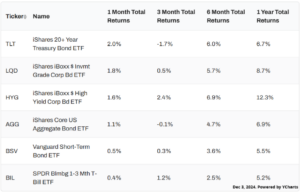

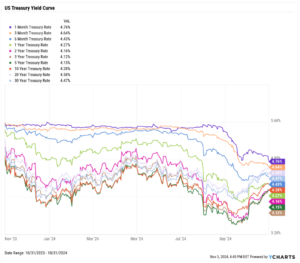

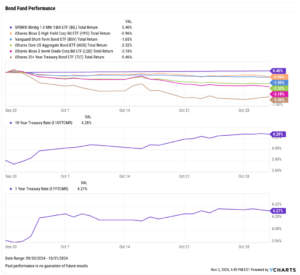

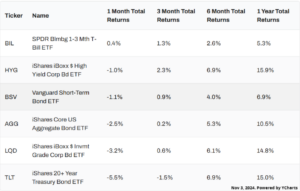

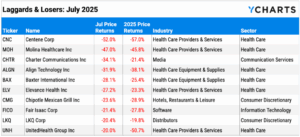

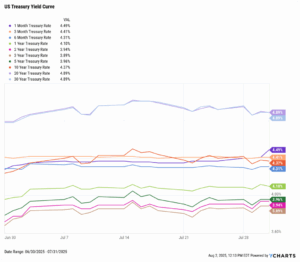

Treasury yields rose across the board in July, with the exception of the 3-month Treasury Rate which stayed flat MoM at 4.41%. The 2-year Treasury Rate logged the highest monthly increase of 22 basis points. Higher yields across the curve pushed prices of bond funds lower, such as the iShares 20+ Year Treasury Bond ETF (TLT), which slipped 1.1% in July.

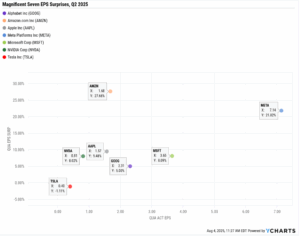

Chappell Wealth Watch! Magnificent Seven Q2 Earnings Surprises

This earnings season, many eyes were fixed to the Q2 reports of the Magnificent Seven stocks for company-specific guidance and potential market-wide outlooks.

Six of the seven Magnificent Seven companies beat their latest earnings estimates by posting a positive EPS surprise. These names were Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), and NVIDIA (NVDA).

The lone outlier? Tesla (TSLA), which missed its earnings estimates by 1.1%.

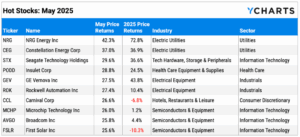

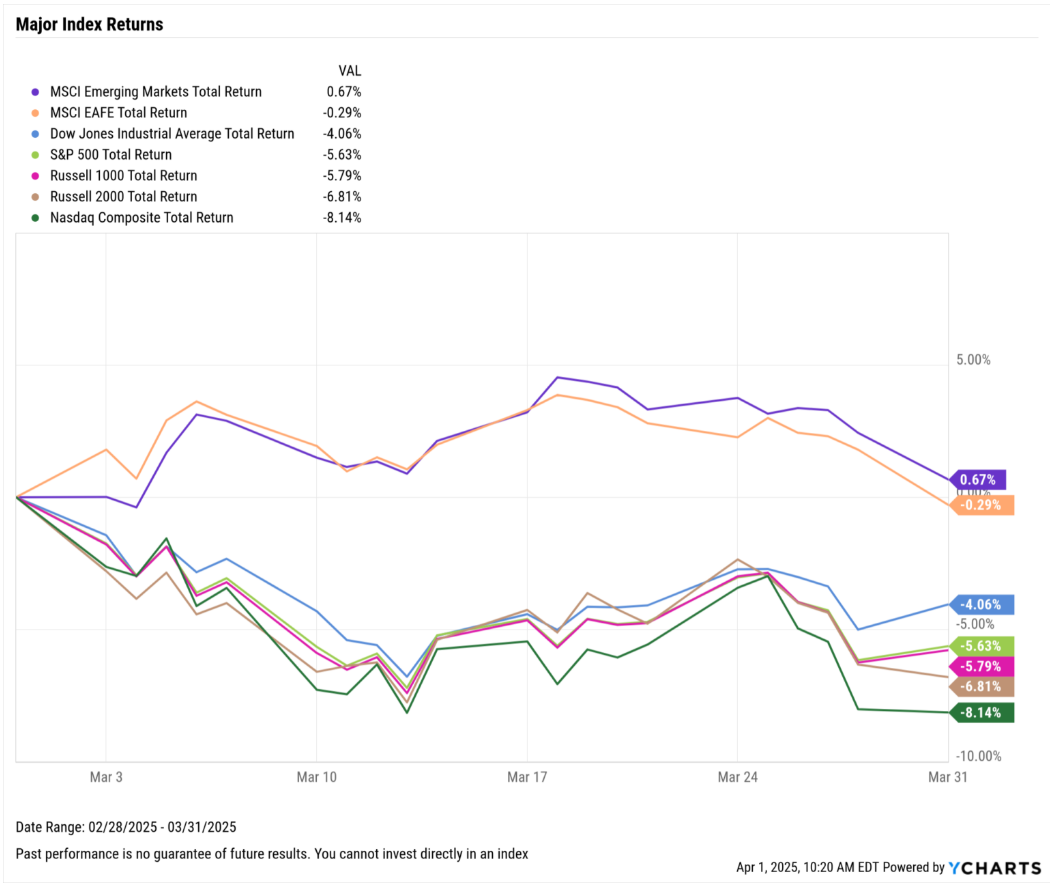

Equity Performance: Equities Begin Second Half of 2025 On Generally Positive Note; Utilities and Tech Lead, Health Care Lags

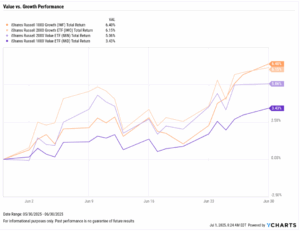

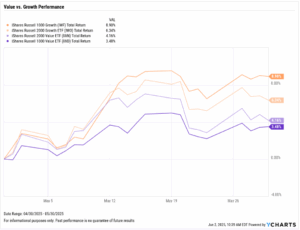

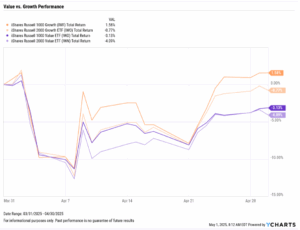

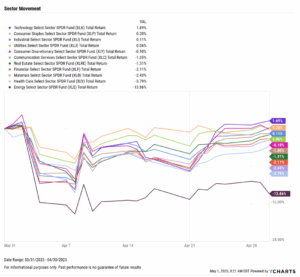

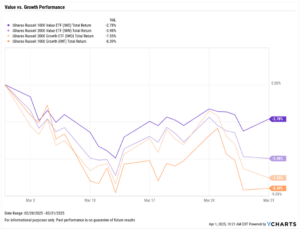

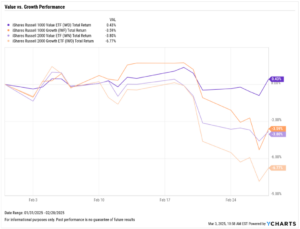

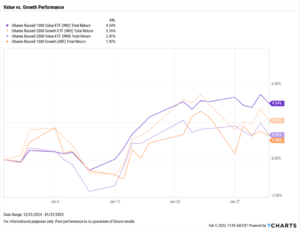

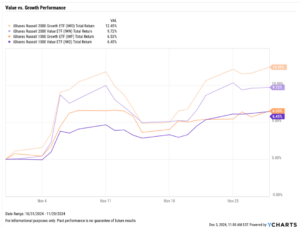

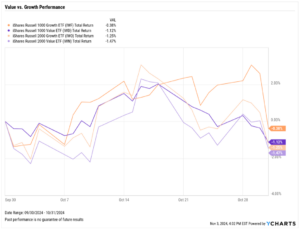

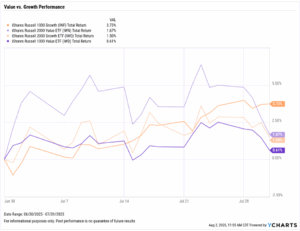

Value vs. Growth Performance

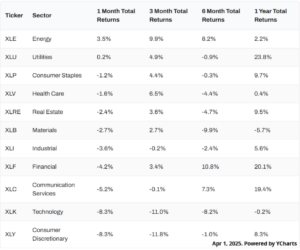

US Sector Movement

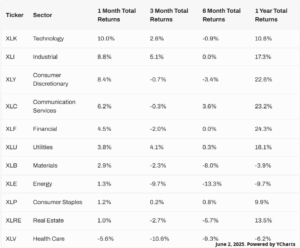

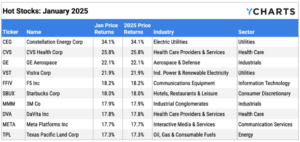

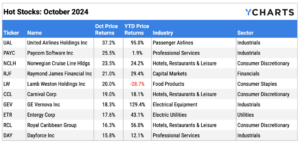

Top 10 S&P 500 Performers of July 2025

10 Worst S&P 500 Performers of July 2025

Economic Data Overview: Oil Prices Climb Higher, Single-Family Home Prices Surpass All-Time High

Employment

The unemployment rate remained at 4.2% in July for the fourth month out of the last five, even as the labor force participation rate fell a tenth of a percentage point to 62.2%. The most recent nonfarm payrolls report showed 73,000 jobs were added to the U.S. economy in July, as payroll figures for both May and June were revised significantly down by more than 250,000 combined.

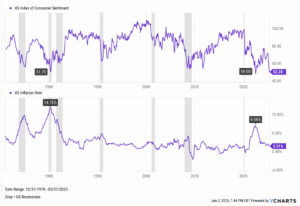

Consumers and Inflation

The US inflation rate logged a slight increase MoM, coming in at 2.67% in June. Core inflation rose to 2.93% between May and June. The US Consumer Price Index inched higher by 0.3% MoM in June, and US Personal Spending grew 0.34% between May and June.

The Federal Reserve maintained its key Fed Funds Rate target range of 4.25%-4.50% at the FOMC’s July 30th meeting, the fifth consecutive meeting in which it has voted to do so. The next meeting will take place on September 17th, at which the majority of investors currently anticipate the Fed will buck its recent trend by cutting the target rate by 25 basis points, according to the CME FedWatch tool.

Production and Sales

The US ISM Manufacturing PMI decreased one point in July to 48.0, while the Services PMI rose 0.9 points to 50.8, putting the latter PMI back into expansion territory. The YoY US Producer Price Index rose slightly to 2.34% in June, and US Retail and Food Services Sales rebounded 0.64% MoM after posting the largest MoM decline in May since April 2023.

Housing

US New Single-Family Home Sales rose 0.64% MoM in June on the heels of a double-digit decline last month, while Existing Home Sales contracted 2.72% in the same month. The Median Sales Price of Existing Homes set a new all-time high in June for the first time since June 2024, climbing 2.74% MoM to $435,300. Mortgage rates were relatively unchanged throughout July; the 15-year Mortgage Rate was 5.85% as of July 31st, while the 30-year ended the month at 6.72%.

Commodities

The SPDR Gold Shares ETF (GLD) rose as much as 3.7% in July before settling at $302.96, a monthly decline of 0.61%. Oil prices increased in July following a volatile June stemming from concerns over diminishing production in the Middle East; the price of Brent crude spiked 4% in July to $70.87 per barrel as of July 31st, while WTI rose 2.3% to $67.81. Despite the higher oil prices, the average price of gas fell four cents to $3.24 per gallon MoM.

Fixed Income Performance: Insights into Bond ETFs & Treasury Yields

US Treasury Yield Curve

Bond Fund Performance